I’ve mentioned the Chinese stock market mania here briefly in recent weeks. I’ve now compiled a fair amount of data along with some interesting anecdotes that show just how crazy it’s gotten so I thought I’d spend this week’s market comment laying it all out for you.

The first thing I like to focus on is valuations. If the dot-com bubble is the gold standard, then China is a bona fide financial bubble. According to Bloomberg:

Valuations in China are now higher than those in the U.S. at the height of the dot-com bubble just about any way you slice them. The average Chinese technology stock has a price-to-earnings ratio 41 percent above that of U.S. peers in 2000, while the median valuation is twice as expensive and the market capitalization-weighted average is 12 percent higher, according to data compiled by Bloomberg.

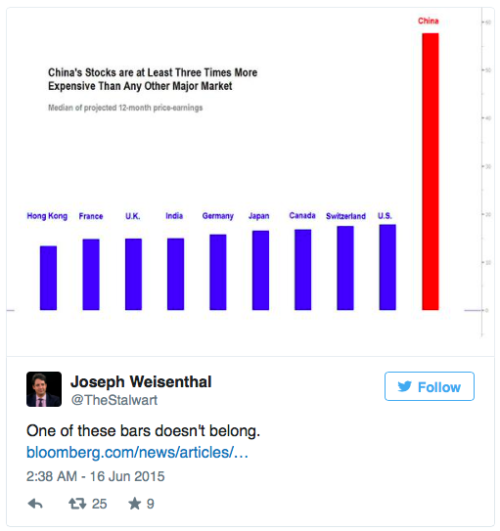

Another way to look at it is to compare current valuations around the world:

I’ve made the case that US stocks are more overvalued than they appear due to the fact that the median stock is now more highly valued than ever. There’s now a very similar but far more dramatic situation going on in China. Again, from Bloomberg:

The problem with the Shanghai Composite is that 94 percent of Chinese stocks trade at higher valuations than the index, a consequence of its heavy weighting toward low-priced banks. Use average or median multiples instead and a different picture emerges: Chinese shares are almost twice as expensive as they were when the Shanghai Composite peaked in October 2007 and more than three times pricier than any of the world’s top 10 markets.

So if US stocks are expensive on a median basis, Chinese stocks are incredibly so. What’s pushed valuations so far is euphoria like we may have never seen here at home. More than any developed stock market in the world, China’s is driven mainly by individual investors rather than institutions. This means that it’s probably more influenced by what Keynes termed “animal spirits” than most. And boy are there signs of those “animal spirits” in China today.

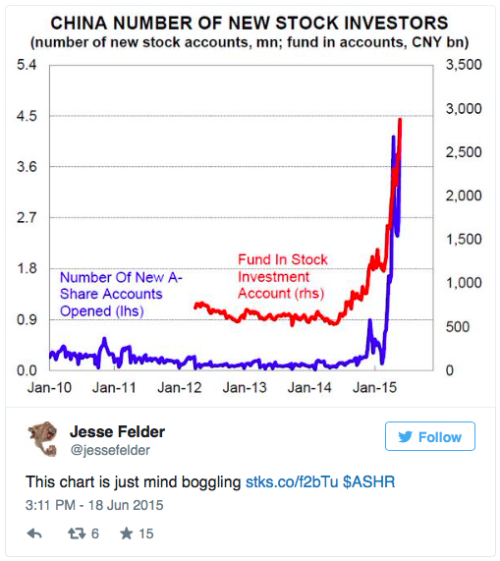

The number of new trading accounts being opened is simply stunning. I don’t know if I’ve ever seen a more dramaticly parabolic rise in anything.

And they’re not just buying stocks with cash. They’re using an incredible amount of debt, aka margin financing, to leverage their purchases right now.

Below is my in:

I will be watching this very carefully tommorrow because this has the stoic reserve of a mexican jumping bean. I got in with the julys because things happen quickly

Also note that our in is not 17.00. Thats what it was going for yesterday before the price jump. Today traders are stunned at the loss so they are all holding it, thus no volume. But we pick it up between the bid and the ask, here that would be 4.80. More later today

Tradinginsider

Forex trading is so difficult and we will help you to be able to choose the BEst Forex EA's according to your needs. A lot of forex traders spend years of trading forex with almost no success, but we provide a proven track of records to ensure that these Stock Logic will really help to improve your trading success.

ReplyDelete