Are you a Millionaire in the Making?

How to add a few more zeros to your bank balance

5 reasons the dollar will get stronger

Here are five reasons the dollar could get stronger soon

After-hours buzz: Tesla, Cisco, L Brands more

A pedestrian uses a mobile device to photograph the New York Stock Exchange

Welcome to the Report!

New Design, and with available extra services to help you profit

This city is taking on Silicon Valley as a start-up haven

This tech hub is churning out start-ups at a startling rate. The skilled talent pool is a big driver of the trend.

Friday, October 30, 2015

Market bouncing around

10:36 AM

No comments

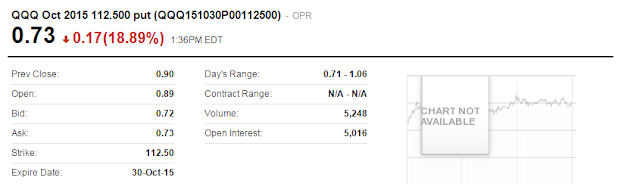

I am going to hold these puts until the end of the day and see if anything goes our way in the afternoon trading. Just an update.

Tradinginsider

Tradinginsider

So, today...

8:58 AM

No comments

If I continue forward on my play the trend thing that I talked about late last night:

Looks like the futures were down this morning and the market is faltering around. Lets go ahead and purchase some QQQ puts and see what shakes out later in the day. My in:

So we will check back in about 2 hrs and see how this thing is doing. If I get 10-20 percent again, Ill exit. This time Im not playing with options that expire today, I moved to next week. Nov 6 expiration.

Ok, see you guys a bit later today!

Tradinginsider

Looks like the futures were down this morning and the market is faltering around. Lets go ahead and purchase some QQQ puts and see what shakes out later in the day. My in:

So we will check back in about 2 hrs and see how this thing is doing. If I get 10-20 percent again, Ill exit. This time Im not playing with options that expire today, I moved to next week. Nov 6 expiration.

Ok, see you guys a bit later today!

Tradinginsider

Checking the issues

8:34 AM

No comments

I am looking around, checking the issues now,

Tradinginsider

Tradinginsider

Thursday, October 29, 2015

Im learning new things....

1:33 PM

No comments

Seeing that we are near the top, I am going to hold off on making a call until I see which way the market is going tomorrow.

I'm starting to like this: I figured out a new thing for the market. If the premarket is down 15 min before open, chances are after the morning fade gap (at 9:30 Central, 10:30 NY time) the market will broadcast which way it is going to go the rest of the day through movement.

Then I get in with the options that are going to expire at the soonest right at the money, right on the right side of it. For example, the SPY option 107 today expire tomorrow. It went a little north of that to 108.75 so the profit was locked in as the option price was following the actual stock price as there was no time, so that worked to my advantage.

So now when the charts are showing top or bottom, I will place a contrarian bet. But day to day I figure I can glean 10-30 percent per day following closely what the market does right after the morning gap fade.

Morning Gap: Prices stack up from the previous night and before open from Traders watching the world markets and the Premarkets. Orders pile up into a big pile before the Market Maker can execute them at open at 8:30 (Central Chicago Time). When the market finally does open, it takes the Market Maker about 30 minutes to fire all those orders off that stacked up before open. While he is executing that glut of orders that were stacked up the market that he is trading reacts to it and will spike or drop accordingly. After this glut is done being executed, the market will typically change directions to the true direction that it wants to go to for the day based on trader sentiment, technicals or fundimentals/market events

So This is when the market opens and spikes up or down for about a half hour, then reverses and goes the other way and does whatever it does for the rest of the day.

Fading the Gap: Using the above information some traders will watch the open. If they see that the stock/ETF in question spikes for the first 30 minutes, they will buy a call or an option at the money right at about 30-35 minutes after the opening bell with an option that is liquid and will expire as soon as possible for maximum volatility and therefore profit. When the market then begins to swing the otherway as the gap fades, they then 15-30 minutes later exit thier option for profit.

So I can either fade the gap or wait until after the gap fade to see which way the market will likely be going for the rest of the day.

I told you about my friend who knew a guy who did the following: He had 100,000 dollars in a brokerage account. At the beginning of each day, 15 minutes before open he would check the premarkets. If they were up, he would instruct his broker at open to move his entire 100,000 dollars in his selection of blue chip stocks. 10 minutes before the end of every day, he would sell everything and have cash again. He would always be in 100% cash overnight, never hold overnight. On days 15 minutes before open if the premarkets were down and in the red, he would simply do nothing for that day and stay in cash.

By doing this system, this guy made 100% each year. 100,000 grand on his 100,000 grand. And to to it off, he didnt sweat things. As a matter of fact after calling his broker at 8:21 am each morning it was out of sight out of mind. His broker had long standing instructions to sell everything no matter what happened in the market that day each day at 2;50pm if he was in the market that day. So after his morning phone call, he would golf all day, go out to lunch, read the paper.

That is when there were no ETF's. What would be able to make if he used the reverse cube ETFs on days when the premarket was down in the red? What if on those days he used the Bear x3 ETF? What would he make then per year? 2 to 3 times his 100,000? While playing golf?

Very interesting. And something I am discovering as I am slowly moving into this realization. Which is why I am suddenly making 10-30 percent a day. Lets see if I can keep this up and continue to fine tune this.

Tradinginsider

I'm starting to like this: I figured out a new thing for the market. If the premarket is down 15 min before open, chances are after the morning fade gap (at 9:30 Central, 10:30 NY time) the market will broadcast which way it is going to go the rest of the day through movement.

Then I get in with the options that are going to expire at the soonest right at the money, right on the right side of it. For example, the SPY option 107 today expire tomorrow. It went a little north of that to 108.75 so the profit was locked in as the option price was following the actual stock price as there was no time, so that worked to my advantage.

So now when the charts are showing top or bottom, I will place a contrarian bet. But day to day I figure I can glean 10-30 percent per day following closely what the market does right after the morning gap fade.

Morning Gap: Prices stack up from the previous night and before open from Traders watching the world markets and the Premarkets. Orders pile up into a big pile before the Market Maker can execute them at open at 8:30 (Central Chicago Time). When the market finally does open, it takes the Market Maker about 30 minutes to fire all those orders off that stacked up before open. While he is executing that glut of orders that were stacked up the market that he is trading reacts to it and will spike or drop accordingly. After this glut is done being executed, the market will typically change directions to the true direction that it wants to go to for the day based on trader sentiment, technicals or fundimentals/market events

So This is when the market opens and spikes up or down for about a half hour, then reverses and goes the other way and does whatever it does for the rest of the day.

Fading the Gap: Using the above information some traders will watch the open. If they see that the stock/ETF in question spikes for the first 30 minutes, they will buy a call or an option at the money right at about 30-35 minutes after the opening bell with an option that is liquid and will expire as soon as possible for maximum volatility and therefore profit. When the market then begins to swing the otherway as the gap fades, they then 15-30 minutes later exit thier option for profit.

So I can either fade the gap or wait until after the gap fade to see which way the market will likely be going for the rest of the day.

I told you about my friend who knew a guy who did the following: He had 100,000 dollars in a brokerage account. At the beginning of each day, 15 minutes before open he would check the premarkets. If they were up, he would instruct his broker at open to move his entire 100,000 dollars in his selection of blue chip stocks. 10 minutes before the end of every day, he would sell everything and have cash again. He would always be in 100% cash overnight, never hold overnight. On days 15 minutes before open if the premarkets were down and in the red, he would simply do nothing for that day and stay in cash.

By doing this system, this guy made 100% each year. 100,000 grand on his 100,000 grand. And to to it off, he didnt sweat things. As a matter of fact after calling his broker at 8:21 am each morning it was out of sight out of mind. His broker had long standing instructions to sell everything no matter what happened in the market that day each day at 2;50pm if he was in the market that day. So after his morning phone call, he would golf all day, go out to lunch, read the paper.

That is when there were no ETF's. What would be able to make if he used the reverse cube ETFs on days when the premarket was down in the red? What if on those days he used the Bear x3 ETF? What would he make then per year? 2 to 3 times his 100,000? While playing golf?

Very interesting. And something I am discovering as I am slowly moving into this realization. Which is why I am suddenly making 10-30 percent a day. Lets see if I can keep this up and continue to fine tune this.

Tradinginsider

Exit same day SPY put for gain

8:12 AM

No comments

Ok, now we are going to exit our same day SPY put for a nice gain.

Our exit:

I will be looking for other opps today,

Tradinginsider

Our exit:

I will be looking for other opps today,

Tradinginsider

AAPL- Time to Invest?

7:44 AM

No comments

I think that AAPL is not quite as innovative under this CEO, but he is steering the ship through some waters that will add some bigger numbers on the bottom line. While the watch is not as big as they thought it would be, people are really on board with the new Iphone 6 and the sales numbers back that up. So with that in mind I give you two charts:

Lets look at the techs above. The williams, or the tech on top of the Apple candlesticks, is topped out and showing overbought. Underneath the candle chart is the ADX chart. The thick black line is not yet sub 12 in reversal territory, it is still at 21. The bottom indicator is still showing green cross over red, which is positive. However looking at the timers of these indicators is showing a short term top, as in there is going to be a bit of a pullback short term. But will Apple grow longer term?

As you can see from the above chart, Apples stock is looking more attractive from a medium term standpoint with the P/E ratio falling below its stock price. While I cant advise on a park your money situation for a couple of years, I can advise that you wait for a pullback in the market then purchase and hold for a few months and then reevaluate from there.

Tradinginsider

Lets look at the techs above. The williams, or the tech on top of the Apple candlesticks, is topped out and showing overbought. Underneath the candle chart is the ADX chart. The thick black line is not yet sub 12 in reversal territory, it is still at 21. The bottom indicator is still showing green cross over red, which is positive. However looking at the timers of these indicators is showing a short term top, as in there is going to be a bit of a pullback short term. But will Apple grow longer term?

As you can see from the above chart, Apples stock is looking more attractive from a medium term standpoint with the P/E ratio falling below its stock price. While I cant advise on a park your money situation for a couple of years, I can advise that you wait for a pullback in the market then purchase and hold for a few months and then reevaluate from there.

Tradinginsider

We go with the trend bad news

7:24 AM

No comments

Today some bad news hit. Perhaps it is enough to topple things for today. Also the Fed showed weakness yesterday and the GDP report was a dud. I think this is a time where the news overrides the technicals. Our in:

Thats it for now, lets ride this out..

Tradinginsider

Thats it for now, lets ride this out..

Tradinginsider

Wednesday, October 28, 2015

10:23 PM

No comments

Ok, our call option grew in price right before close yesterday:

And that was up from 1.66 where we had bought it earlier yesterday morning.

Now the chart was showing 'continuation' as of close yesterday so if the gap fades in the morning we will have a good idea of the direction by 930 Chicago Central Time.

Tradinginsider

And that was up from 1.66 where we had bought it earlier yesterday morning.

Now the chart was showing 'continuation' as of close yesterday so if the gap fades in the morning we will have a good idea of the direction by 930 Chicago Central Time.

Tradinginsider

Thats all for today

12:29 PM

No comments

Hold on to those SPY calls see you tomorrow! Looks like the market will continue upward after the fed announcement today

Tradinginsider

Tradinginsider

What a roller coaster ride!

12:16 PM

No comments

That big swing down really got my attention after the fed announcement...wow! Holding until close to close then stay tuned

Tradinginsider

Tradinginsider

Exit yesterday SPY put hold call today

9:54 AM

No comments

We exit our SPY put from yesterday and hold todays call.

Our exit from the put:

We hold todays call until near close. That put is up and am hoping to balance out the above loss.

Tradinginsider

Our exit from the put:

We hold todays call until near close. That put is up and am hoping to balance out the above loss.

Tradinginsider

Market strange with Fed announcement

7:34 AM

No comments

Today there is going to be another Fed announcement and seeing that I dont know what the results are going to be, I am going to place myself in a spread situation. I already have puts from yesterday, today I am going to purchase some calls that expire a bit sooner for more potential price movement. My in:

So hopefully there is good movement one way or another today.

More a bit later,

Tradinginsider

So hopefully there is good movement one way or another today.

More a bit later,

Tradinginsider

Good Morning

7:21 AM

No comments

Waiting to see if this is an early gap fade and waiting to see the general direction of the market....

Will I have to reverse myself and sell the put and go with a call? Or leave it alone....hmmm. Watching, will report as things develop.

Tradinginsider

Will I have to reverse myself and sell the put and go with a call? Or leave it alone....hmmm. Watching, will report as things develop.

Tradinginsider

Tuesday, October 27, 2015

Market looks topped: Purchase SPY puts

11:01 AM

No comments

So today I am watching a topped market. Also, reverse hammers on the QQQ charts. I think this baby is going to take a header. So below is my in for SPY puts that I am going to hold until tomorrow or the day after.

That will be all for today unless there is a late day crazy drop.

Tradinginsider

That will be all for today unless there is a late day crazy drop.

Tradinginsider

Exit QQQ Put for Profit

10:20 AM

No comments

Ok, we bought this 2 hrs ago and we just turned almost 20%. In 2 hrs. Thats pretty damned good considering most people would be happy with that kind of return in a year. But I am not going to be blowing my own horn in light of my 1 month recent picking meltdown. Im just going to slowly keep climbing the hill.

Ok, we are out below at:

And my previous post has my in just in case you want to look at that.

So that will do it for today, close to 20 percent should do it. I will see you tomorrow.

Tradinginsider

Ok, we are out below at:

And my previous post has my in just in case you want to look at that.

QQQ Oct 2015 113.000 put (QQQ151030P00113000)

-OPR Watchlist

0.84  0.17(16.83%) 11:34AM EDT

0.17(16.83%) 11:34AM EDT

| Prev Close: | 1.01 |

|---|---|

| Open: | 1.03 |

| Bid: | 0.84 |

| Ask: | 0.85 |

| Strike: | 113.00 |

| Expire Date: | 30-Oct-15 |

| Day's Range: | 0.75 - 1.09 |

|---|---|

| Contract Range: | N/A - N/A |

| Volume: | 2,803 |

| Open Interest: | 6,328 |

So that will do it for today, close to 20 percent should do it. I will see you tomorrow.

Tradinginsider

QQQ put for today

8:54 AM

No comments

Today since the market seems to be skirting around the top, I am going to purchase a QQQ put and sit on this today and may try to exit before market close, looking to make ?10%? today. Below is my in:

I will check back later to see how it is doing...

Tradinginsider

QQQ Oct 2015 113.000 put (QQQ151030P00113000)

-OPR Watchlist

0.84  0.17(16.83%) 11:34AM EDT

0.17(16.83%) 11:34AM EDT

| Prev Close: | 1.01 |

|---|---|

| Open: | 1.03 |

| Bid: | 0.84 |

| Ask: | 0.85 |

| Strike: | 113.00 |

| Expire Date: | 30-Oct-15 |

| Day's Range: | 0.75 - 1.09 |

|---|---|

| Contract Range: | N/A - N/A |

| Volume: | 2,803 |

| Open Interest: | 6,328 |

I will check back later to see how it is doing...

Tradinginsider

Monday, October 26, 2015

Gambling Systerm Part 2

4:31 PM

3 comments

Hey guys.

In part one of my system I showed you guys how to make money on free odds. Now I am going to show you my statistical system.

The crux is most people seven out within the first 5 rolls as the advantage is to the house. Go to a casino craps table and watch what happens when there is a cold streak. Its like standing at a funeral as the dice gets passed around a table.

Then, someone has a hand and makes two points in a row. Then the table lights up.

Here is how this works.

Wait until a new shooter gets the dice. Wait until he comes out and makes a point number so the puck gets slid over to one of the point numbers: 4, 5, 6, 8, 9, 10. When he or she first gets the dice, they have to roll one of these in order for the puck to get slid over to one of these numbers, this shooter then has that number as the POINT. They then try to reshoot that point number before they roll a 7 in order to win their line bet. Of course unless the shooter is hot, odds say that a 7 will be rolled first and the house takes all losing bets. So:

1. Walk up to a table, get your chips (I recommend minimum 1000 dollars at a 10 dollar table as there will be drifts in your bankroll, 1500 preferred.).

2. Wait until a new shooter gets the dice. Then wait until they establish their point number. That is you will not be doing anything yet until the point number gets established. If they are coming out (new roll with no point established yet) they can roll 7, 11. 2, 3, etc and you will just be sitting there waiting doing nothing. Until a point number is thrown (established): 4,5,6,8,9,10.

3. Once they establish thier point, you start counting. The point number they just threw? That was "One". Now seeing the point is already established no matter what they throw 9, 3, 2, 6, 11, 10 etc is going to be "Two". (unless its a 7 out in which case we have to start this all over again with a new shooter). Now before their next throw, the throw that you would count "Three", you are going to do this:

Place 10 dollars on the 'Any 7'. (in the picture above, its two 5 dollar chips).

If it wins, good, take your money and then start the whole thing over with the next new shooter that gets the dice passed to them. If it loses, seeing that is a one roll proposition bet, the dealer will take it. Now you are on roll number "Four". If Replace the bet including +1 dollar, So now you will have 11 dollars in the Any Seven box. If it wins (meaning the shooter just rolled a 7 for a 7 out) great, take the money and start over with the next shooter that the dice gets passed to. If the shooter does not throw a 7 you stop betting. You have just bet on "Three" and "Four" by placing a bet on the 'Any Seven' and lost both times. Now you wait not betting for two things:

1. The shooter to eventually 7 out no matter how long/many rolls it takes

2. The shooter makes two points in a roll (the shooter has the passbet line pay off twice making two point numbers in a row that the puck was on).

If the shooter that you are now waiting on makes two point numbers while shooting (the table gets the line paid twice) you now do this:

Seeing that the same shooter just made his/her second point, they still keep the dice and they are coming out again. You place a bet on the passline, the amount whatever the amount currently is on your any 7 bets. Remember the above where you lost the first 10 dollar bet "Three" and now the second bet, or "Four" that you put +1 on your original bet of 10 dollars? This is a running total. Every time you lose a "three" it is +1 dollar on the "Four" bet. If you lose that "Four" bet you remember the total that you had on that "Four" bet and the next time you are up for Any Seven bets you add +1 onto the next "Three" bet.

So to simplify the above paragraph, the any 7 is a running count. Every time you lose an Any Seven bet, the next bet is +1 dollar. You start with 10 bucks and you might get up into the 30's., 40's or 50 dollar range. Or more.

So back to previous. When a shooter gets the dice and you lose both your Any Seven bets on "Three" of the count and "Four" of the count you sit out and wait. If that same shooter makes two point numbers while shooting before he lets the dice go to the next person, You then bet the amount (you are currently at via the running count on the Any Seven) on the pass line. So lets say your running count is 43 on the Any Sevens, and the shooter just made two points in a row. You then put 43 on the passline WITHOUT COUNTING right on his comeout roll. No need to wait until he makes a point now this time. You put it down on the pass line for his comeout roll. If he throws a 7 or 11, you win on the passline and take your 43 dollars that the dealer slides over to you and put it on your chip rack, leaving your original bet of 43 on the passline. If the shooter throws a 2,3,or 12, you will have to replace your bet of 43 dollars on the passline.

Once the shooter comes out and establishes a point, you will now have a 43 dollar bet (your current bet level from your Any Seven bet) on the passline, and now you make a 43 dollar bet on the come. once that come bet is slid over to a point number, you now have two numbers working. Take all the winnings and keep putting them on your rack. If your come bet number comes down because the shooter hits it, put that same bet amount back up on the come. If the shooter hits his point number and the passline gets paid which means you get 43 dollars from your passline bet, take the money and leave 43 dollars on the passline. If on the new comeout roll the shooter rolls a 7, you'll get paid on the passline but lose your comebet. As soon as the shooter makes his point, put another come bet back up so you always have two points working until the shooter 7s out.

That was the particulars. To simplify it,

In part one of my system I showed you guys how to make money on free odds. Now I am going to show you my statistical system.

The crux is most people seven out within the first 5 rolls as the advantage is to the house. Go to a casino craps table and watch what happens when there is a cold streak. Its like standing at a funeral as the dice gets passed around a table.

Then, someone has a hand and makes two points in a row. Then the table lights up.

Here is how this works.

Wait until a new shooter gets the dice. Wait until he comes out and makes a point number so the puck gets slid over to one of the point numbers: 4, 5, 6, 8, 9, 10. When he or she first gets the dice, they have to roll one of these in order for the puck to get slid over to one of these numbers, this shooter then has that number as the POINT. They then try to reshoot that point number before they roll a 7 in order to win their line bet. Of course unless the shooter is hot, odds say that a 7 will be rolled first and the house takes all losing bets. So:

1. Walk up to a table, get your chips (I recommend minimum 1000 dollars at a 10 dollar table as there will be drifts in your bankroll, 1500 preferred.).

2. Wait until a new shooter gets the dice. Then wait until they establish their point number. That is you will not be doing anything yet until the point number gets established. If they are coming out (new roll with no point established yet) they can roll 7, 11. 2, 3, etc and you will just be sitting there waiting doing nothing. Until a point number is thrown (established): 4,5,6,8,9,10.

3. Once they establish thier point, you start counting. The point number they just threw? That was "One". Now seeing the point is already established no matter what they throw 9, 3, 2, 6, 11, 10 etc is going to be "Two". (unless its a 7 out in which case we have to start this all over again with a new shooter). Now before their next throw, the throw that you would count "Three", you are going to do this:

Place 10 dollars on the 'Any 7'. (in the picture above, its two 5 dollar chips).

If it wins, good, take your money and then start the whole thing over with the next new shooter that gets the dice passed to them. If it loses, seeing that is a one roll proposition bet, the dealer will take it. Now you are on roll number "Four". If Replace the bet including +1 dollar, So now you will have 11 dollars in the Any Seven box. If it wins (meaning the shooter just rolled a 7 for a 7 out) great, take the money and start over with the next shooter that the dice gets passed to. If the shooter does not throw a 7 you stop betting. You have just bet on "Three" and "Four" by placing a bet on the 'Any Seven' and lost both times. Now you wait not betting for two things:

1. The shooter to eventually 7 out no matter how long/many rolls it takes

2. The shooter makes two points in a roll (the shooter has the passbet line pay off twice making two point numbers in a row that the puck was on).

If the shooter that you are now waiting on makes two point numbers while shooting (the table gets the line paid twice) you now do this:

Seeing that the same shooter just made his/her second point, they still keep the dice and they are coming out again. You place a bet on the passline, the amount whatever the amount currently is on your any 7 bets. Remember the above where you lost the first 10 dollar bet "Three" and now the second bet, or "Four" that you put +1 on your original bet of 10 dollars? This is a running total. Every time you lose a "three" it is +1 dollar on the "Four" bet. If you lose that "Four" bet you remember the total that you had on that "Four" bet and the next time you are up for Any Seven bets you add +1 onto the next "Three" bet.

So to simplify the above paragraph, the any 7 is a running count. Every time you lose an Any Seven bet, the next bet is +1 dollar. You start with 10 bucks and you might get up into the 30's., 40's or 50 dollar range. Or more.

So back to previous. When a shooter gets the dice and you lose both your Any Seven bets on "Three" of the count and "Four" of the count you sit out and wait. If that same shooter makes two point numbers while shooting before he lets the dice go to the next person, You then bet the amount (you are currently at via the running count on the Any Seven) on the pass line. So lets say your running count is 43 on the Any Sevens, and the shooter just made two points in a row. You then put 43 on the passline WITHOUT COUNTING right on his comeout roll. No need to wait until he makes a point now this time. You put it down on the pass line for his comeout roll. If he throws a 7 or 11, you win on the passline and take your 43 dollars that the dealer slides over to you and put it on your chip rack, leaving your original bet of 43 on the passline. If the shooter throws a 2,3,or 12, you will have to replace your bet of 43 dollars on the passline.

Once the shooter comes out and establishes a point, you will now have a 43 dollar bet (your current bet level from your Any Seven bet) on the passline, and now you make a 43 dollar bet on the come. once that come bet is slid over to a point number, you now have two numbers working. Take all the winnings and keep putting them on your rack. If your come bet number comes down because the shooter hits it, put that same bet amount back up on the come. If the shooter hits his point number and the passline gets paid which means you get 43 dollars from your passline bet, take the money and leave 43 dollars on the passline. If on the new comeout roll the shooter rolls a 7, you'll get paid on the passline but lose your comebet. As soon as the shooter makes his point, put another come bet back up so you always have two points working until the shooter 7s out.

That was the particulars. To simplify it,

- Do a 5 count on a new shooter. Wait until he hits a point number on the come out. As soon as he hits a point number and the puck slides over, that's "One" any thing else he throws besides a 7 out is "Two". On "Three" and "Four" count, you have a bet on the 'Any Seven' of 10 dollars. If no seven out on three and four, you stand there and do nothing until the next shooter OR if he makes two points in a row go to number three below.

- Every bet you lose on Any Seven you put +1 dollar on the next bet. If you lose "Three" its 11 dollars on "Four". If you lose that too, the next time you 5 count a new shooter and once again get to "Three" you are going to put 12 dollars down. Its a running +1 increase after each loss.

- Every time a shooter makes two points in a row (has to be in a row or else its a 7 out and the dice goes to the next shooter) you then put a bet on the passline and after a point is established, one also on the come so you now have two points working (dont use odds)

- The amount that you use for these two bets from number 3 above is whatever number you are currently at with your running number total from above number 2 with the Any Seven play. If you are currently at 32 on the Any Sevens this is the number that you will bet on with the passline/come bet

So it really comes down to this: You are betting on the three and four of a shooters roll betting that he will 7 out, kind of like a reverse 5 count. With the shooters that get hot and make two points in a row, you suddenly start betting on them.

Oh, and to fight standard deviation, as in to stop your bankroll from swinging around too much, everytime you hit +50 or +75 dollars over what you walked in with, simply reset the whole thing to 10 dollars again. (on the any 7 and the line/come bet running total).

I would suggest you practice this on the wizardofodds.com free site (play for free) before heading off to a real casino. And never play craps online with real money. A lot of these casinos online are based out of the country and are not regulated. How do you know that the computer code hasnt been written to give the casino a bigger edge than a normal physical pair of dice? You don't. Whenever real money starts happening with online casinos/cards/sports betting scams start happening that fleece the average person.

I remember there were a few ex-programmers who left Ultimate Bet a former poker US poker site when online poker was the rage from 2007-2009 and PokerStars, UB, Party Poker were making Billions of dollars. A few of these ex programmers from UB set up in an offshore island with some servers and with the passcodes they still had active from when they were programmers (I dont know why they were still active) they got in real money card games and logged in as Administrators so they could SEE EVERYONES CARDS IN THE ONLINE POKER ROOM in Ultimate Bet.com. Then as administrors they played using real money and stole millions of dollars and funneled the money to offshore accounts. I dont think they were even prosecuted.

You may have been watching TV for the last few months and have seen all these fantasy sports sites like Fanduel and DraftKings talking about how they award millions per week. Easy money, right? Check this article:

A class action lawsuit was filed in federal court in Manhattan on Thursday accusing DraftKings and FanDuel of negligence, fraud and false advertising.

The case was brought by Adam Johnson of Kentucky, who says he deposited $100 into a DraftKings account.

The suit claims that daily fantasy games put forth by the two companies are misrepresented as fair. That case is made mainly through the recently revealed policies of the two companies that allowed employees to enter contests on the other's site for cash prizes, along with the rest of the population.

"DraftKings performs analytics to determine winning strategies, return on investment of certain strategies and even how lineups on FanDuel would do if they were entered into DraftKings contests," the suit alleges.

With these strategies potentially available to some employees, those employees could have a potential advantage by playing on a competitor's site.

FanDuel spokesperson Justine Sacco told ESPN.com earlier in the week that DraftKings employees have won 0.3 percent of the money FanDuel has awarded in its entire history. With a ballpark figure of $2 billion awarded so far, that's around $6 million. It is not known how much those DraftKings employees spent on entry fees.

DraftKings co-founder Paul Liberman said at a conference last month at Babson College that some of the company's employees made more off other fantasy sites than their salaries at DraftKings.

Representatives from both DraftKings and FanDuel said their companies would have no comment on the litigation.

The suit names DraftKings and FanDuel as defendants. The suggested class is specified as only people who put money in a DraftKings account before Oct. 6 and competed in a contest where employees of other daily fantasy companies participated.

Both sites said this week they would permanently ban the practice of employees competing on the competitor's site, or any other daily fantasy site.

This came after a DraftKings employee's posting of player roster percentages and his subsequent $350,000 take in a FanDuel contest raised questions about inside information.

One prevailing thought is that if a person had access to how many people selected certain players on rosters before those rosters were locked, they would have an edge. This is because top prizes are often won by individuals with a player who appears on fewer rosters but comes through with a big game.

DraftKings said its own investigation of that employee, Ethan Haskell, found that Haskell didn't have access to advantageous information before he entered his lineup on FanDuel that week.

While there is concern from the public, thus far neither company has said it has found any employee who had access to information that specifically provided him or her an advantage in a contest.

Both FanDuel and DraftKings also announced this week the hiring of third-party consultants to look into potential impropriety and review practices within the companies.

It just goes to show you that when you think you see a road to easy money and there is a huge media swell advertising this, remember to take it with a very big grain of salt. My way above is a grind. But its a grind that works. DraftKings, Cards (now illegal) and real estate? Anything with an easy barrier of entry is very difficult to get to the top of the heap and make good money. If you join a real estate office like Caldwell Banker or Century 21 on the office tour you will see that one guy or gal that is the office real estate star. They have all the glass awards and trophies, triple black diamond seller, they make 1.6 million dollars a year, take all the trips and are wired and networked with customers. Everyone else in that office makes 30 to 60 grand a year. Its that same way in auto dealerships and anywhere else there is an easy barrier for entry. Any auto dealer will hire you as a salesman as long as you look put together and are wearing a nice suit. But they will only keep the producers. Most people wont make it in auto sales or real estate. Or in Professional Poker or DraftKings. They have a very exclusive small top of the pyramid and everyone else going for the free big money just arent going to get it.

The path to big money? Dont take the route that everyone else tries to take. The well beaten path doesnt work. You have to have something that no one else has to offer and take the solo road. Create a new type of business or product. Find a niche that isnt being serviced and service the hell out of it. Find a new way. Steve Jobs? invented personal computing in his garage. Bill gates? Invented the operating system for those personal computers. Get there first, discover something big, walk the lonely path for something that the world needs. Put your thinking cap on.

Tradinginsider

Update...exit QQQ option for 12% gain

11:45 AM

No comments

We now exit our QQQ option for a 11-12% gain in several hours.

Below is our exit:

Looking for more trades...

Tradinginsider

Below is our exit:

Looking for more trades...

Tradinginsider

Today: A QQQ put..looking at the top//

10:59 AM

No comments

In looking at the chart today I am seeing some top stagnation, two crosses next to each other. So with a 53% confindence, I am going to do a put on the cubes right near at the money, 122.50s. If something goes wrong I will be willing to double down once I get a clearer signal.

Here is my in:

Tradinginsider

Here is my in:

Tradinginsider

Determining mood of the day

7:45 AM

No comments

I am trying to get a handle on the market today and which way it is thinking of going. Should take about an hour.

Tradinginsider

Tradinginsider

Friday, October 23, 2015

Exit same day QQQ call

10:51 AM

No comments

Today we exit our same day QQQ purchase. We made about 30 something percent today. Below is our out:

Stay tuned for later for my second part gambling system.

Tradinginsider

Stay tuned for later for my second part gambling system.

Tradinginsider

Today we are going with the daily trend...purchase QQQ call

7:19 AM

No comments

Trying to get my mojo back. Today we are going to purchase a QQQ call at the money and see how we do. Then later today I am going to give you part two of my gambling system for craps. My in:

Looking aroud for other things today as well.

Tradinginsider

Looking aroud for other things today as well.

Tradinginsider

Thursday, October 22, 2015

Win at the Casino with this Craps System

11:58 AM

2 comments

If you have about 200-250 starting bank you can walk up to a 10 dollar minimum table. If you walk up to a 15 min table or a 25 min table, you will have to adjust your starting bank accordingly. (750 for 25 table, 400 for 15 table).

Change your money at the table for 5 dollar chips and then place your bet. Do this:

You put 10 dollars on the pass line and you put 10 dollars on the don't pass line. Now some people might look at you weird and you might even get a smartass dealer making a comment, but screw them. Normally people wont do/say anything. If you do get a smartass dealer simply leave the table and go to another one. Remember going to school? Almost every classroom had a smartass.

Here is the just of what we are doing: The only bet on the table that does not contain a house edge that is a true odds payoff is the odds bet. You notice that there is not signs on a table that says bet the odds. Thats because the casino has no desire to advertise a bet that has no edge for them, but they offfer it to customers, just on the down low. Note the right of the table with the prop bets (where all the yellow pictures of the dice are and ratio odds) and see how they are hawking those bets. Thats because those odds ratios are way slanted in their favor to the tune of the casino having a 15-16% edge. Stay away from those bets. For example, the true payoff of a 12 being rolled is 35-1. They are paying off at 30-1. So the 12 is going to come up in a statistical time period correct for how the design of the dice allows, but they are not paying out correct odds, they are short paying you. Which means your bankroll is going to slowly (or quickly) disappear. But I digress, back to my method.

When you walk up to the table and get your chips you wait until a point is made or a 7 out happens and everyone gets paid or loses thier chips. Then on the next new shooter, you go into action and put the above pictured bet down (10 pass, and 10 dont pass) right before the come out roll. If the shooter rolls a 3,2, 7, 11. 12 or any other non point number where the passline or dont pass gets taken away and the other line gets simotaniously paid off, just replace your bets again: 10 on the pass and 10 on the dont pass. Sometimes 1 in 36 rolls, you'll get a 12 thrown which means you lose your pass line but not get paid on your dont pass. Dont sweat it, its rare. Just the cost of doing business. Now, if a shooter rolls a point on his come out, the puck will get slid over to the point number. Here in this case, the shooter after a few 7s and 3's where you put the do or dont back up waiting for him to roll a point number finally rolls a point number and the puck gets slid over to 5:

You are bypassing the house edge by betting on the do and dont on the comeout. You just want the desicion, win or lose, to be based on your free odds. If you were just betting on the passline or don't passline you would be subjected to a -1.51% edge (negative). But since we were betting on both the pass and dont pass line now our edge is close to 0 by just gambling with the free odds. (close to 0, remember the bar 12 that can happen albeit rarely on the comeout.)

Comeout roll: When new shooter gets the dice (dice possession goes around the table in order). Before the point number is made ( point numbers 4, 5, 6, 8, 9, 10) he or she is having their comeout roll...this is when a 7, 3, 2, 11 and 12 can be rolled that either pay bettors on the pass line or dont pass line. Once a better rolls one of the above point numbers, from that moment on, they are trying to repeat that number again before a 7 gets rolled.

Now after the point is made, you place single odds on the don't pass bet and leave them there for 4 rolls. (you have to count each time the bettor tosses the dice as a roll). Chances are the shooter is going to 7 out during these 4 rolls. If they do, take your payoff and start over again with a new shooter.

If 4 rolls goes by and there is no decision, there is a good chance the shooter is having a good roll. Simply pick up your dont pass odds (you can do that) and move them over to the pass line and put those odds behind your pass line:

Like the above. Now sit there and wait for a decision no matter how many rolls it takes, win or lose. I almost forgot to tell you. When you bet single odds behind the passline, it doesnt matter what the point number is, you just put 10 bucks behind your original passline bet of 10 bucks like above. However, if you are betting the Don't Pass odds, you have to make the odds match the number so the dealer can give you a correct payoff. If the point is 4 or 10, you have to put 20 dollars behind your bet. If the point is 5 or 9 you have to put 15 dollars behind your dont bet. If the point is 6 or 8 you have to lay 12 behind the don't bet. With no percentage against you from the house (except the 12 roll on the comout only) hopefully the drift will walk upwards yourway as most shooters tend to 7 out early especially on a cold table.

One more thing: If the shooter makes two points in a row (they hit 2 point numbers while they are shooting without a 7 out) this shooter is hot. When this happens, instead of setting up on the pass and dont pass, simply put a 10 dollar bet on the passline:

And wait for the shooter to come out. Here since the shooter is hot we are assuming that we dont have to protect our bets from the house edge as the shooter apparently has some edge or is just lucky. Hopefully the shooter will throw a few 7s or 11s that you can pocket (keep leaving the bet up on the passline) and if he throws a 2,3,12 and your pass line bet goes down, put it back up there until the shooter makes a point number. When he does, you will make an additional come bet:

This is like a passline bet but in the middle of a shoot while the shooter has a point number already established. Then on the next roll, if it is a 2,3,11 you might get paid on the come bet at a 1:1 or you might lose the come bet. If you get paid, pocket the 10. If you lose the come bet, put it back up. You are waiting for a point number to be thrown so it can slide to that number:

Now you have two points working. Keep two point working at all times until the shooter 7s out. For example, the shooter may hit the point number (9) and the line gets paid. He didnt 7 out yet. You need to put a line bet back up. He could then roll another 7 on the comeout (not a 7 out because its a comeout roll hes trying to establish his next point number) so then you get paid on the passline, but your comebet above gets taken out. When he makes his next point number, then place another come bet so that things look like the above...a bet on the passline and a bet that you placed on the come sitting on a point number so that you have two points working at all time, taking payoffs and putting them back up until the shooter sevens out.

I find that this works, even though standard deviation will take a walk all around 60-100 dollars, but then will cinch its way back up. I usually profit from this 50-100 per table. I will leave a table when up this amount and look for another table.

One time I was playing this and was up 170 dollars and I saw two pit bosses looking at me talking. One then came over and informed me that I could only bet the passline or the don't passline, and not both. So I left that table and that casino and went to another casino and continued.

When something like this happens:

Change your money at the table for 5 dollar chips and then place your bet. Do this:

You put 10 dollars on the pass line and you put 10 dollars on the don't pass line. Now some people might look at you weird and you might even get a smartass dealer making a comment, but screw them. Normally people wont do/say anything. If you do get a smartass dealer simply leave the table and go to another one. Remember going to school? Almost every classroom had a smartass.

Here is the just of what we are doing: The only bet on the table that does not contain a house edge that is a true odds payoff is the odds bet. You notice that there is not signs on a table that says bet the odds. Thats because the casino has no desire to advertise a bet that has no edge for them, but they offfer it to customers, just on the down low. Note the right of the table with the prop bets (where all the yellow pictures of the dice are and ratio odds) and see how they are hawking those bets. Thats because those odds ratios are way slanted in their favor to the tune of the casino having a 15-16% edge. Stay away from those bets. For example, the true payoff of a 12 being rolled is 35-1. They are paying off at 30-1. So the 12 is going to come up in a statistical time period correct for how the design of the dice allows, but they are not paying out correct odds, they are short paying you. Which means your bankroll is going to slowly (or quickly) disappear. But I digress, back to my method.

When you walk up to the table and get your chips you wait until a point is made or a 7 out happens and everyone gets paid or loses thier chips. Then on the next new shooter, you go into action and put the above pictured bet down (10 pass, and 10 dont pass) right before the come out roll. If the shooter rolls a 3,2, 7, 11. 12 or any other non point number where the passline or dont pass gets taken away and the other line gets simotaniously paid off, just replace your bets again: 10 on the pass and 10 on the dont pass. Sometimes 1 in 36 rolls, you'll get a 12 thrown which means you lose your pass line but not get paid on your dont pass. Dont sweat it, its rare. Just the cost of doing business. Now, if a shooter rolls a point on his come out, the puck will get slid over to the point number. Here in this case, the shooter after a few 7s and 3's where you put the do or dont back up waiting for him to roll a point number finally rolls a point number and the puck gets slid over to 5:

You are bypassing the house edge by betting on the do and dont on the comeout. You just want the desicion, win or lose, to be based on your free odds. If you were just betting on the passline or don't passline you would be subjected to a -1.51% edge (negative). But since we were betting on both the pass and dont pass line now our edge is close to 0 by just gambling with the free odds. (close to 0, remember the bar 12 that can happen albeit rarely on the comeout.)

Comeout roll: When new shooter gets the dice (dice possession goes around the table in order). Before the point number is made ( point numbers 4, 5, 6, 8, 9, 10) he or she is having their comeout roll...this is when a 7, 3, 2, 11 and 12 can be rolled that either pay bettors on the pass line or dont pass line. Once a better rolls one of the above point numbers, from that moment on, they are trying to repeat that number again before a 7 gets rolled.

Now after the point is made, you place single odds on the don't pass bet and leave them there for 4 rolls. (you have to count each time the bettor tosses the dice as a roll). Chances are the shooter is going to 7 out during these 4 rolls. If they do, take your payoff and start over again with a new shooter.

If 4 rolls goes by and there is no decision, there is a good chance the shooter is having a good roll. Simply pick up your dont pass odds (you can do that) and move them over to the pass line and put those odds behind your pass line:

Like the above. Now sit there and wait for a decision no matter how many rolls it takes, win or lose. I almost forgot to tell you. When you bet single odds behind the passline, it doesnt matter what the point number is, you just put 10 bucks behind your original passline bet of 10 bucks like above. However, if you are betting the Don't Pass odds, you have to make the odds match the number so the dealer can give you a correct payoff. If the point is 4 or 10, you have to put 20 dollars behind your bet. If the point is 5 or 9 you have to put 15 dollars behind your dont bet. If the point is 6 or 8 you have to lay 12 behind the don't bet. With no percentage against you from the house (except the 12 roll on the comout only) hopefully the drift will walk upwards yourway as most shooters tend to 7 out early especially on a cold table.

One more thing: If the shooter makes two points in a row (they hit 2 point numbers while they are shooting without a 7 out) this shooter is hot. When this happens, instead of setting up on the pass and dont pass, simply put a 10 dollar bet on the passline:

And wait for the shooter to come out. Here since the shooter is hot we are assuming that we dont have to protect our bets from the house edge as the shooter apparently has some edge or is just lucky. Hopefully the shooter will throw a few 7s or 11s that you can pocket (keep leaving the bet up on the passline) and if he throws a 2,3,12 and your pass line bet goes down, put it back up there until the shooter makes a point number. When he does, you will make an additional come bet:

This is like a passline bet but in the middle of a shoot while the shooter has a point number already established. Then on the next roll, if it is a 2,3,11 you might get paid on the come bet at a 1:1 or you might lose the come bet. If you get paid, pocket the 10. If you lose the come bet, put it back up. You are waiting for a point number to be thrown so it can slide to that number:

Now you have two points working. Keep two point working at all times until the shooter 7s out. For example, the shooter may hit the point number (9) and the line gets paid. He didnt 7 out yet. You need to put a line bet back up. He could then roll another 7 on the comeout (not a 7 out because its a comeout roll hes trying to establish his next point number) so then you get paid on the passline, but your comebet above gets taken out. When he makes his next point number, then place another come bet so that things look like the above...a bet on the passline and a bet that you placed on the come sitting on a point number so that you have two points working at all time, taking payoffs and putting them back up until the shooter sevens out.

I find that this works, even though standard deviation will take a walk all around 60-100 dollars, but then will cinch its way back up. I usually profit from this 50-100 per table. I will leave a table when up this amount and look for another table.

One time I was playing this and was up 170 dollars and I saw two pit bosses looking at me talking. One then came over and informed me that I could only bet the passline or the don't passline, and not both. So I left that table and that casino and went to another casino and continued.

When something like this happens:

- Leave that table and Casino. Come back during another shift of workers 8 hrs later or dont come back for a week. But they will remember that style of play due to its strangeness.

- Work with a co conspirator. Walk in as if you two don't know each other. They bet the dont pass with the odds and everything and you bet the pass with the odds and everything the system entails. You both have 200 of chips in front of you, and after you are done, simply both leave the casino with what you have won/lost and once in the car combine everything and it will be like one player did the above system. Only two did it with stealth.

I have seen people betting on the passline and the dont passline at the same time and no one cares. It might come up now and then however. Sometimes casino personnel will be watching winners. And if they don't want any red ink during their shift on their win/loss reports, they might just tell you that its one or the other to nullify what you are doing so that maybe you'll leave.

Well thats part 1 of my casino system as a way of telling you to stick with me, my trading will get better. If you go to a local riverboat, or AC or Vegas, use the above to keep your bankroll in the black.

Tradinginsider

Exit QQQ put option+ fuckup month

9:39 AM

No comments

Exit the below option before the value drops to zero.

I am not going to turn around and purchase a call option as that is not contrarian to purchase a call on a day when the ETF is roaring. Instead, I wait for pullbacks.

You may have noticed that I am having a very bad month. I was golden all the way up to 30 days ago and then the train came off the tracks. I wonder if I am losing my predictive ability.

Then I thought no. I have not. Even casinos have some bad months even though they have a long term edge. I am just having a bad month. I just have to whittle things down to the basics when reading charts. Red does not mean drop necessarily, but it is a good hint. What went wrong today? The market took off. Yesterday's candle was not a top candle, even though it was red. It was solid with a light tail underneath, telling that the market would continue to climb.

So from now on, I can only predict what is going to happen the next day during the last 15 minutes of the trading day as the absolute last candle is being formed in its final configuration. I am going to sit out of the QQQ and SPY until I see a top candle.

So in order to make up for my fuckup month, I have decided to share two casino craps secrets with you. That will be my next post.

Tradinginsider

I am not going to turn around and purchase a call option as that is not contrarian to purchase a call on a day when the ETF is roaring. Instead, I wait for pullbacks.

You may have noticed that I am having a very bad month. I was golden all the way up to 30 days ago and then the train came off the tracks. I wonder if I am losing my predictive ability.

Then I thought no. I have not. Even casinos have some bad months even though they have a long term edge. I am just having a bad month. I just have to whittle things down to the basics when reading charts. Red does not mean drop necessarily, but it is a good hint. What went wrong today? The market took off. Yesterday's candle was not a top candle, even though it was red. It was solid with a light tail underneath, telling that the market would continue to climb.

So from now on, I can only predict what is going to happen the next day during the last 15 minutes of the trading day as the absolute last candle is being formed in its final configuration. I am going to sit out of the QQQ and SPY until I see a top candle.

So in order to make up for my fuckup month, I have decided to share two casino craps secrets with you. That will be my next post.

Tradinginsider

Wednesday, October 21, 2015

Here is why Im not sweating the action today

11:59 AM

No comments

I think that the market is right on the top and just before a fall...lets look at the chart:

If you look all the way back on the chart, everytime the chart was topping near the top there were red candles. And look at the curve of the candles, the arc is topped and starting to curve down. Also, the top indicator, the RSI is starting to already come down. When the RSI goes one way and the candles are going another, thats called divergence as the candles almost always turn and follow the RSI. The macd, the indicator on the bottom, is also in overbought territory.

So we are going to hold our put. Hopefully things drop tomorrow, we are up against a time wall, options expire this friday. However if it is down big, we will make good money.

Tradinginsider

If you look all the way back on the chart, everytime the chart was topping near the top there were red candles. And look at the curve of the candles, the arc is topped and starting to curve down. Also, the top indicator, the RSI is starting to already come down. When the RSI goes one way and the candles are going another, thats called divergence as the candles almost always turn and follow the RSI. The macd, the indicator on the bottom, is also in overbought territory.

So we are going to hold our put. Hopefully things drop tomorrow, we are up against a time wall, options expire this friday. However if it is down big, we will make good money.

Tradinginsider

Hello...chcking issues now

8:40 AM

No comments

Seeing the markets techs, looking around, be back...

Tradinginsider

Tradinginsider

Tuesday, October 20, 2015

Reversal Showing purchase QQQ puts

12:10 PM

No comments

We are going to purchase QQQ puts..I jumped the gun on the calls. Today was the top day. So we reverse:

And we are going to get out of our calls by exiting at the below:

Thats all for today. We see how this works out tomorrow.

Tradinginsider

And we are going to get out of our calls by exiting at the below:

Thats all for today. We see how this works out tomorrow.

Tradinginsider

hmmm. possible reversal coming...

11:00 AM

No comments

I will have to monitor this..it looks like a possible reversal...

tradinginsider

tradinginsider

Purchase QQQ calls

8:05 AM

No comments

Today we are going to do an exploritory QQQ call and we are just going to hold it for one day...unless I see the candlesticks support more up tomorrow by the end of the day. Our in:

note that this expires pretty soon, but I did that on purpose as I want this to move more, hopefully in the direction I am looking for.

Stay tuned.

Tradinginsider

note that this expires pretty soon, but I did that on purpose as I want this to move more, hopefully in the direction I am looking for.

Stay tuned.

Tradinginsider

Checking issues now, good morning

7:54 AM

No comments

I will be right back after I check the markets...

Tradinginsider

Tradinginsider

Monday, October 19, 2015

Tuesday and Wed. Forecast

10:42 PM

No comments

Well it looks as though we are in a decent uptick climb. Lets look at the chart below for SPY:

The Aroon indicator isnt showing anything for a few days, and the candles themselves are showing a strong continuation for at least 2-4 more days. While the ADX (bottom indicator) is in line for a reversal as the thick black line of that indicator is below the value of 20, it does not mean that it will immediately happen...look at August 1-18 with its value below 20 (indicating reversal coming) for 18 days.

At this point seeing that we are near the top of the range I will be buying call options and dumping them the same day before close..purchasing at the money.

See you Tues Morning.

Tradinginsider

The Aroon indicator isnt showing anything for a few days, and the candles themselves are showing a strong continuation for at least 2-4 more days. While the ADX (bottom indicator) is in line for a reversal as the thick black line of that indicator is below the value of 20, it does not mean that it will immediately happen...look at August 1-18 with its value below 20 (indicating reversal coming) for 18 days.

At this point seeing that we are near the top of the range I will be buying call options and dumping them the same day before close..purchasing at the money.

See you Tues Morning.

Tradinginsider

Family Issues Monday

5:40 PM

No comments

Where the hell was tradinginsider on Monday??

Sorry guys for no update yesterday. I got up and immediately had to get in a car and was taking care of family issues all day so I didn't even have time to look at the market. I will be back tomorrow morning.

I am also going to go through all of my issues and figure out where I stand. The market went against me huge and I have a lot of put options out there laungishing. But this is the stock market and not only is it about making money, its about how you deal with loss and making some bad calls.

And this is how I deal with it..the train rolls on. I realize that I cant do anything about big mistakes and instead concentrate on putting the train back on the track and watching the smoke and debris in the rear view mirror.

So what am I going to do about all those ailing puts back there? It looks as though that the market is going to be topping in the next 3-5 days, and when it starts to cycle down I am just going to have to jettson those puts and try to get whatever I can out of them, instead of just letting them expire at zero.

How did I make that mistake? Pride. I figured that I was making so much money that my timing was good based on my sixth sense that the market was "due" to turn so I stopped following the candlesticks. The candlesticks besides the news are almost absolute. They did a double reverse hammer reversal and then the next day they did ANOTHER double hammer reversal. Seeing that I wasn't following the candles, it was like I was walking around blind bumping into things.

So: Its back to hardcore candlestick analysis. And I am going to start fresh with this in the morning. What I am thinking is purchasing some puts early in the morning (providing that the premarket is up 15 minutes before open) and riding the market up tomorrow and selling the call right before close. I may do this for a few days before I see the new top signal.

That's all for now, my next post will have my prediction for tomorrows market based on my candlestick and technical analysis.

Tradinginsider

Sorry guys for no update yesterday. I got up and immediately had to get in a car and was taking care of family issues all day so I didn't even have time to look at the market. I will be back tomorrow morning.

I am also going to go through all of my issues and figure out where I stand. The market went against me huge and I have a lot of put options out there laungishing. But this is the stock market and not only is it about making money, its about how you deal with loss and making some bad calls.

And this is how I deal with it..the train rolls on. I realize that I cant do anything about big mistakes and instead concentrate on putting the train back on the track and watching the smoke and debris in the rear view mirror.

So what am I going to do about all those ailing puts back there? It looks as though that the market is going to be topping in the next 3-5 days, and when it starts to cycle down I am just going to have to jettson those puts and try to get whatever I can out of them, instead of just letting them expire at zero.

How did I make that mistake? Pride. I figured that I was making so much money that my timing was good based on my sixth sense that the market was "due" to turn so I stopped following the candlesticks. The candlesticks besides the news are almost absolute. They did a double reverse hammer reversal and then the next day they did ANOTHER double hammer reversal. Seeing that I wasn't following the candles, it was like I was walking around blind bumping into things.

So: Its back to hardcore candlestick analysis. And I am going to start fresh with this in the morning. What I am thinking is purchasing some puts early in the morning (providing that the premarket is up 15 minutes before open) and riding the market up tomorrow and selling the call right before close. I may do this for a few days before I see the new top signal.

That's all for now, my next post will have my prediction for tomorrows market based on my candlestick and technical analysis.

Tradinginsider

Friday, October 16, 2015

Good Day: NFLX

9:33 AM

No comments

Today while we are sitting around waiting for the market to do something, we are going to get in on Netflix on the dip. This is a mini leap, and I think its a good time to get in based on my previous post here. Remember, these are March 2016's thus the higher price...

Our in:

Thats all for now, lookikng around for more action.

Tradinginsider

Our in:

Thats all for now, lookikng around for more action.

Tradinginsider

Thursday, October 15, 2015

Now Im in trouble

1:02 PM

No comments

I missed a signal yesterday: a second double hammer reversal, which told me that the previous double hammer reversal got cancelled, and a new reversal pattern going the other way is the direction.

Here's what happened:

I saw a reversal pattern, which suggested a drop. But the very next day candle showed up, and this new candle in combination of the days before candle now showed ANOTHER reversal, this time to the upside.

So that screws me over very nicely, seeing I have a shitload of puts out there. My only hope at this point is the fed says something messed up to get things dropping again. Also, the long term QQQ is looking dismal, as in there is going to be a crash soon:

You can see that there is some blips that are starting to happen. Note how the two indicators have been steadily dropping, the top RSI and the bottom MACD. The candle chart has been climbing, this is known as divergence. Almost always, the candlestick charts will turn around and start following the indicators.

We will see how I will get out of this one, this should be interesting. I am going to have to go over all my positions and see where Im at.

Tradinginsider

Here's what happened:

I saw a reversal pattern, which suggested a drop. But the very next day candle showed up, and this new candle in combination of the days before candle now showed ANOTHER reversal, this time to the upside.

So that screws me over very nicely, seeing I have a shitload of puts out there. My only hope at this point is the fed says something messed up to get things dropping again. Also, the long term QQQ is looking dismal, as in there is going to be a crash soon:

You can see that there is some blips that are starting to happen. Note how the two indicators have been steadily dropping, the top RSI and the bottom MACD. The candle chart has been climbing, this is known as divergence. Almost always, the candlestick charts will turn around and start following the indicators.

We will see how I will get out of this one, this should be interesting. I am going to have to go over all my positions and see where Im at.

Tradinginsider