I have always been a gambling enthusiast. What really sparked my interest in gambling was the new riverboat legislation in illinois/chicago area that allowed gambling riverboats in the Chicago area.

As soon as craps, roulette and blackjack showed up I went out and bought a slew of books on how to beat them.

It turns out that most of them were crap, and even some of them quite possibly were working with the casinos. I would say that once every 3 or 4 years a book would come out that was a true ground-breaker such as Frank Sclobete's five count method, or a dice control book by Sharpshooter, things that could eventually through practice give the player a slight edge.

For the most part I was going to the casino and still leaving my donation.

Most people never develop the skills to control the dice as it takes several years to really become proficient at it. Many people have practiced and attempted to make a living at it with the reality of it showing them still at a negative expectation and them having to come back to thier full time regular job.

Then I made a discovery last week. I found the God Code.

Math in Nature

It turns out in nature, there is a sequence of numbers that repeat over and over again. This was rediscovered from Indian Mathematicians by an Italian looking to describe the population growth of rabbits. The following is from Wikipedia:

A tiling with squares whose side lengths are successive Fibonacci numbers

or (often, in modern usage):

(sequence A000045 in OEIS).

(sequence A000045 in OEIS).

The Fibonacci spiral: an approximation of the

golden spiral created by drawing circular arcs connecting the opposite corners of squares in the Fibonacci tiling;

[3] this one uses squares of sizes 1, 1, 2, 3, 5, 8, 13, 21, and 34.

By definition, the first two numbers in the Fibonacci sequence are 1 and 1, or 0 and 1, depending on the chosen starting point of the sequence, and each subsequent number is the sum of the previous two.

In mathematical terms, the sequence

Fn of Fibonacci numbers is defined by the

recurrence relation

with seed values

or

The Fibonacci sequence is named after

Fibonacci. His 1202 book

Liber Abaci introduced the sequence to Western European mathematics,although the sequence had been described earlier in

Indian mathematics.

[6][7][8] By modern convention, the sequence begins either with

F0 = 0 or with

F1 = 1. The

Liber Abaci began the sequence with

F1 = 1, without an initial 0.

Fibonacci numbers are closely related to

Lucas numbers in that they are a complementary pair of

Lucas sequences. They are intimately connected with the

golden ratio; for example, the

closest rational approximations to the ratio are 2/1, 3/2, 5/3, 8/5, ... . Applications include computer algorithms such as the

Fibonacci search technique and the

Fibonacci heap data structure, and graphs called

Fibonacci cubes used for interconnecting parallel and distributed systems. They also appear in biological settings,

[9] such as branching in trees,

phyllotaxis (the arrangement of leaves on a stem), the fruit sprouts of a

pineapple,

[10] the flowering of an

artichoke, an uncurling

fern and the arrangement of a

pine cone.

[11]

This sequence can be found in pretty much everything. Lets look at a few examples:

Here is the sequence drawn out and below to it notice that it manifests in nature such as a nautilous shell:

|

| The Fibonacci number sequence in physical representation |

|

| This shell is basically designed as a Fibonacci sequence |

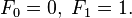

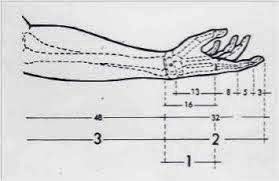

This also manafests in how the human body is designed:

The numbers are everything...from how our hands to the poportions of the construction of our bodies.

|

| Every Aspect of the proportions of our body...Fibonacci sequence. |

|

| relationship of arm to hand to fingers |

|

| make up of your face |

|

| make a fist...yup, Fibonacci all the way |

|

| Even how the ear is designed |

It is also found in plants and nature:

|

| The reproduction of rabbits follows a Fibonacci sequence in nature |

|

| Fibonacci number in the spiral design of this plants center |

|

| Yes, even the very spiral in Galaxies: Fibonacci spirals. |

|

| Plants branch out using Fibonacci numbers |

|

| It is also found in the petal allocation in a rose or any flower for that matter |

|

| Fibonacci numbers are found in hurricanes and rotations of storms |

|

| Yes, it is even encoded in our very DNA |

Not only is this the underlying developmental matrix in the physical world, but it also as it turns out regulates our behaviors and supposed chance events. Wait, are you friggin kidding me? I smell something big coming....

The Elliot Wave

Some people think that the stock market is random fluctuations. Its not. Its behaviors are actually following a Fibonacci sequence and this was discovered by Ralph Nelson Elliot. From wikki:

The Elliott wave principle is a form of technical analysis that some traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Ralph Nelson Elliott (1871–1948), a professional accountant, discovered the underlying social principles and developed the analytical tools in the 1930s. He proposed that market prices unfold in specific patterns, which practitioners today call Elliott waves, or simply waves. Elliott published his theory of market behavior in the book The Wave Principle in 1938, summarized it in a series of articles in Financial World magazine in 1939, and covered it most comprehensively in his final major work, Nature’s Laws: The Secret of the Universe in 1946. Elliott stated that "because man is subject to rhythmical procedure, calculations having to do with his activities can be projected far into the future with a justification and certainty heretofore unattainable."

But wait, there is more:

|

From R.N. Elliott's essay,

"The Basis of the Wave Principle," October 1940. |

The Elliott Wave Principle posits that collective investor psychology, or

crowd psychology, moves between optimism and pessimism in natural sequences. These mood swings create patterns evidenced in the price movements of markets at every degree of

trend or time scale.

In Elliott's model, market prices alternate between an impulsive, or

motive phase, and a corrective

bear market the dominant trend is downward, so the pattern is reversed—five waves down and three up. Motive waves always move with the trend, while corrective waves move against it.

phase on all time scales of trend, as the illustration shows. Impulses are always subdivided into a set of 5 lower-degree waves, alternating again between motive and corrective character, so that waves 1, 3, and 5 are impulses, and waves 2 and 4 are smaller retraces of waves 1 and 3. Corrective waves subdivide into 3 smaller-degree waves starting with a five-wave counter-trend impulse, a retrace, and another impulse. In a

What is the underlying foundation of this? Fibonacci numbers:

R. N. Elliott's analysis of the mathematical properties of waves and patterns eventually led him to conclude that "The Fibonacci Summation Series is the basis of The Wave Principle".

[1] Numbers from the

Fibonacci sequence surface repeatedly in Elliott wave structures, including motive waves (1, 3, 5), a single full cycle (8 waves), and the completed motive (89 waves) and corrective (55 waves) patterns. Elliott developed his market model before he realized that it reflects the Fibonacci sequence. "When I discovered The Wave Principle action of market trends, I had never heard of either the Fibonacci Series or the Pythagorean Diagram".

[1]

The Fibonacci sequence is also closely connected to the

Golden ratio (1.618). Practitioners commonly use this ratio and related ratios to establish support and resistance levels for market waves, namely the price points which help define the parameters of a trend.

[5] See

Fibonacci retracement.

Robert Prechter replied to the Batchelor–Ramyar study, saying that it "does not challenge the validity of any aspect of the Wave Principle...it supports wave theorists' observations," and that because the authors had examined ratios between prices achieved in filtered trends rather than Elliott waves, "their method does not address actual claims by wave theorists".

[7] The Socionomics Institute also reviewed data in the Batchelor–Ramyar study, and said these data show "Fibonacci ratios do occur more often in the stock market than would be expected in a random environment".

[8]

Extracted from the same relationship between Elliott Waves and Fibbonacci ratio, a 78.6% retracement level is identified as a best place for buying or selling (in continuation to the larger trend) as it increases the risk to reward ratio up to 1:3.

It has been suggested that Fibonacci relationships are not the only irrational number based relationships evident in waves.

[9]

So the supposed random events of the market aren't actually so random after all. I then started to think. Where else in human events does this pop up in? Can this be a predictive light in sequences of events previously thought to be non predictive? I then started to look at past events to see if fibonnachi was an underlying foundation:

The above is a sequence of major events in history..and yes, the code can be overlayed over it. Lets look at another one..

|

Matthew has "Alright alright alright."

Keanu has "Woah." |

Woah..this is getting either creepy or more amazing. Not only is this the building block to everything in the physical world, we are also adhering to it in our behaviors? Do you know what this means?

This means that the entire world of chaos that we thought we lived in actually is more ordered than we thought. And, I further reasoned, perhaps a bit more predictive.

AND, I REASONED, MAYBE I CAN APPLY THIS TO GAMBLING.

God's Code: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597, 2584, 4181, 6765, 10946, 17711, 28657, 46368, 75025, 121393, 196418, 317811, ...

God's Code and Craps

I then had to figure out how to use this information and be able to apply it to craps. Many people have attempted to overlay this Ferrari over a Yugo and failed. For example, people would go up to the table and right on the line start betting the sequence and then run right up to unsustainable bankroll numbers and walk away wearing thier ass for a hat. You see, the dice table is very streaky. You would think that the dice would be going back and forth but that is actually not the case. I estimate that 60-70% of the time dice tables are cold. I personally have been at dice tables where no one was able to hit their point for over two hours. Just "7 out! Line away!" over and over again, with people groaning and looking around exasperated, everyone losing thier money. It looks as though there is a funeral when there is a table like this. Not a good time. Ive tried it all. Last win post, 2 in a row, 3 in a row, double after a win, etc. It seems to work temporarily, but then the mathematical edge from the dice begin to manifest in the sequence of events at the table and then the dice start to work against you. You bet lasts, then the table starts to reverse follow your bets almost as if there is a guy working for the casino with a magnet under the table. Same thing if you walk up to a cold table and try the sequence on the dark side..suddenly the table will heat up. No, there had to be something else.

Well after a few weeks, I finally found it. Below are the 4 systems that I use in order of bankroll starting with the most bankroll ($10,000) all the way to a starter bankroll ($500).

1)

$10,000 Starting Bankroll: The reason why this bankroll is so big is to handle the statistical deviation that occurs when playing this system. The first thing you might think of is, "Yeah, right. 10 grand." But not to worry, you are going to build up to 10 grand by using the lessor steps below. Kind of like Poker steps when you were allowed to legally play poker online, building up your bankroll. But I digress

To begin with, when I play this system, I always use last. That is, if the last decision was "7 out, line away!" I bet on the don't pass. If the last call was "winner! Pay the line!" I bet on the pass line. Lets say the last bet was a winner. Most tables now are a 10 dollars minimum bet. The fibbonachi numbers are as follows:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377... The first number of this sequence is a zero, and that in our case is implied. We are at a table with a 10 dollar minimum bet so we are going to be using the numbers here times 10. So every number you see in the above sequence just add a zero on the end of it. This is because there are no longer any tables with a minimum bet of 1 dollar. So we are just going to modify the Fibonacci sequence using a base 10 system, ie mult everything by 10. Same factor, same effect. We put 10 down on the line. Any wins we just take and we stay the same point in the system. Any losses such as craps where the line bet gets taken, we move one more step down the progression. Then when a point gets established, we place a bet on the come with one more step up the progression, and then for the next roll we place another come bet one more step up the progression again, and finally another come bet with one more step up the progression. What we want to end up with here is one line bet and 3 come bets out there. Every time one of our bets gets taken down by a win on a number, we want to replace it with a new come bet

one more step up the progression until we go three more steps up the current spot in the progression and then we just stop betting and if we are still winning, letting all the numbers hit and get paid off and taken down until we are just left with one number working out there whereupon we start back over again at the first step in the progression if the shooter has not yet sevened out. Sounds pretty confusing, so lets play one out, step by step.

The last decision was a win, the line was paid out. So we are going to be betting right. I place 10 dollars on the line (first fibbonachi number is 1, am just multiplying it by 10 as there are no tables with a 1 dollar minimum bet. Since I am converting the Fibonacci sequence x10, all of the Fibonacci numbers in the sequence have to also be multiplied by 10). The shooter throws the dice, and he throws a 7. The pass line wins. I take the win money, and leave my bet up on the line, I am still at the first spot (first 1) in the sequence. The shooter then throws an 11. Pass line winner. I take the winnings and my 10 dollar bet remains on the line, I am still at the first spot of the Fibonacci sequence. Next the shooter then rolls a 3 and I lose my line bet with a craps number. I then advance things one more bet up the Fibonacci sequence and move ahead to the second 1 (multiplied here by 10) so again I have 10 dollars on the pass line. Shooter rolls a 2 (craps) and the bet gets taken by the dealer. I then advance one more bet up the sequence and now I have 20 dollars on the passline. Shooter rolls a 5. The point is now 5 and I make a come bet one more number up the sequence of 30 dollars. The shooter now rolls a 9 and now I make another come bet of 50 dollars. The shooter rolls a 10 and I make another come bet of 80 dollars (another move up the fibbinochi sequence).

Now I have all the bets up that I want up for now, I have one line bet and 3 come bets working, for a total of 4 numbers working. Each time a number wins and gets paid off and taken down, I want to make another come or line bet to keep 4 numbers working for 3 more times. So if any number hits and gets paid off (whether it is the 20, 50, 30 or 80 dollars) I bet one more up the fibbonachi list. So for example, the 10 hits, and my 50 dollars gets paid and comes down. Seeing that my last biggest bet on the fibbonachi sequence is 80 dollars, I now place 130 dollars in the come or on the line to get 4 numbers back up working. As more numbers hit, my next bet would here be 210 and then 340. I would then stop going up the ladder, and stop adding more bets, letting numbers hit and get paid off or having the shooter shoot a 7 and lose all my bets. Hopefully no 7 will be thrown and the shooter will keep cranking off numbers and my numbers will all hit and get paid off. I will then wait for either or and if all my numbers are being hit and paid off, I will wait until I just have one number working out there and then start all over again and build up to 4 working numbers not including the one thats already sitting out there in case it hasnt paid off as of yet. I like to only go +3 to +4 bets up the fibbonachi sequence past the point where I finally have 4 numbers working. Most of the time you will have 10 dollars, 10 dollars, 20 dollars and 30 dollars up and working. In my previous example, we lost the first two bets in the sequence so we were at 20 dollars, 30 dollars, 50 dollars and 80 dollars out there. From that point, seeing that I only want +3 or so more bets up the fibbonachi sequence, after each bet came down by being hit and paid off, seeing our last current bet was at 80 dollars, we continued making bets keeping 4 points working by placing 130 dollars, 210 dollars and then 340 dollars. We stop there because its uncomfortable to really go further and its not nessesary. At point we just stop and wait: Either we will have our numbers hit and we get paid off or the shooter is going to seven out and then we would start this entire thing over but on the Dont Pass side. Unless of course there was a lot of crap outs at the beginning advancing us on up the fibbonachi list. But that is very rare.

Now lets say the shooter 7s out. In this case, we are now going to be betting on the Don't Pass Line.

Here we are going to be doing the same but on the dont pass with a +3 or +4 additional climb up the fibboanchi ladder if any of our four dont bets get hit. Lets get started. We put 10 dollars on the dont line. The shooter is coming out. He rolls a 7. We lose our bet. So now we go one more bet up the fibbonacchi line and the second bet up is also 10 dollars. He throws a 3. We get paid, we leave our current bet up and do not progress up the ladder. The next toss is a 5. Now since we were already at the second step on the ladder, we now place 20 bucks, the third step up the ladder, in the dont come box. The next roll is 9, and the 20 slides over to the dont 9. We then place 30 dollars in the dont and that slides to the 6, then we bet 80 on the dont and that slides to the 8. Now we have 4 points working. Now that we have 4 working, if we lose three more numbers we will go three more steps up the rung if nessesary. Such as next roll, the 6 gets hit, so your dont six gets taken down, so we then put up 120 dollars in the dont and the shooter just so happens to roll a 6, and the 120 goes over to that. I will go two more steps up like this then stop no matter what happens or the shooter could go ahead and roll a 7 and then I could get massively paid off.

Now what could happen is I have 4 donts working and suddenly the dont pass goes down, as in the shooter makes his point. Then we switch over to the do side while our dont bets are still out there on the board. We start over the fibbonachi sequence on the first step, at step one with 10 bucks on the pass line. The shooter rolls a 7. BOOM. Suddenly not only is the line paid, but all the dont bets that were hanging out there are also paid in an avalanche.

So basically you are going to be following the side that won last, switching back and forth as needed while using a fibonachi sequence climbing up the ladder until you have 4 points working and as an additional 3 points are either lost (on the dont) or won ( on the do) you then continue up the ladder and place three more bets up the ladder then stop and let whatever happens or get hit or paid or knocked off happens. Of course, if you get action before you add three more steps up the ladder when you already have 4 points working out there such as a 7 out, you just start over with the first step, 10 dollars on the side that just one the last decision.

I am going to post some videos of me playing this live on the wizard of odds to give you a live example of the above so you can follow it while I play. When you are actually able to see me play while I explain it it will become clear. Those videos should be up in several days.

Video one will go here Video two will go here

2. $2000 starting bankroll: This one is actually a little bit easier. Whereas the last one above it didnt matter how many people were at the table, if it was cold or hot, with this one we want to stay away from cold tables. A cold table could be a hardship. So with this one, we are only at tables that are half full or more. As soon as just one person walks away that makes the table slightly under half full, stop and either wait or move to another hotter table. The rationale behind this is when a table is going good, nobody goes anywhere. Are you kidding me? Walk away from money? Nobody moves, everyone is rooted. When a table sucks, and there is 7 out after 7 out, it looks like a funeral. People are looking around with disgusted looks on thier faces, kinda half into things, looking around the casino, and there wont be much chips on the felt. At a hot or warm table, there will be a lot of chips on the felt and people will be happy and paying attention. So for a quick ID, only tables half full or more.

With hardways bets, you can start at one dollar, the table min doesnt apply here. So we are going to use the fibbonachi sequence literally with the hardways.

Shooter comes out, point is whatever. We place 1 dollar on all of 4 of the hardways. Every time an easy way takes down one of our hardways, we place the same amount back up on that hardway...we always have the 4 hardways covered. We take all payoffs while leaving our 4 hardways numbers up. Every time there is a 7 out and our hardways get taken down, we go one more step up the ladder. So at the 7 out, we go one more step up the fibonacchi ladder and that is again 1 (the second step). We place a dollar on all 4 of our hardways after the come out. (hardways dont work on comeouts. If a 7 is thrown during a comeout, we do not lose our money, so we do not have to advance one more step up the ladder, only on a true working 7 out that makes the dice go to the next shooter do we go one more step up the ladder. As easyways take down any number, we place that amount bet we are at back up no matter how many times. Hopefully we are hitting hardways now and then.

The next 7 out gets us up to the bet of 2. We bet 2 bucks on all 4 of the hardways. We are again replacing any of the 2 dollar bets that go down while we are working due to easy way throws and taking any payoffs. And so on.

Any time after a 7 out you are 60 bucks ahead of where you started or the last point you were 60 bucks ahead, you start over at the beginning of the progression. I myself have been using 50 dollar bets on all 4 hardways and even 80 dollar bets. But by that time it was like 130 rolls later and statistically, I got a clump of hardways that came through and suddenly I was up 240 dollars. I also will put up a video by the end of the week right here so you can see me playing it live so you can follow along.

Video here

I have never gotten through 150 rolls without a clump of hardways. Heres a good way to get into this system based on statistical compression. Seeing that hardways tend to come through lumpy in clumps, wait until you see no hardways rolled for 30 rolls, then jump in. It would have to get to roll 180 with no hardways and thats probably not happening.

What the? Why does this work to the point where I can profit long term?

Its a hack. Its hacking the universe. I suppose in this universe as well as every other universe (if you subscribe to the emerging multiverse theory) there are sets of underlying laws of gravity, motion, time, that allows something of a three dimensional space to exist. Scientists working on string theory have even speculated that this universe has 11+ dimensions to it, over-rapped on top of each other occupying the same space. Some have even speculated that we are living in a big quantum hologram. Whatever the case, the foundation, the very fabric of this universe has physical structure and rules. There is an order out of the chaos. Because in TRUE chaos mass as we know it wouldn't exist and therefore gravity, light or physical beings. Planets and stars wouldnt have been able to be formed. If they were initially formed, they wouldn't stay together long as they would fall apart. So there is an order, or an underlying matrix. Look at those pictures above. Our physical structures, plants structures, weather, galaxies are all based on that mathematical sequence. And so it would seem human interaction is guided by this as we exist in this physical world.

Can I profit from this long term? Studies have been done using Elliot Wave theory and they have found that a certain point in the wave retracement that there is a permanent 1:3 (risk reward) advantage gain if all trading is conducted at that point. I am not sure at what point of these two systems there is an edge over the casino, but I will tell you this: I have built up some pretty sizable bankrolls and have had some pitbosses giving me the stink eye wondering why I'm gaining when everyone else is donating.

What I do is start with two other systems I use because they require a lower amount of money to utilize and as a variant of Scolblete's 5 count and Doey-Don't system to get the odds way down.

3. $1000 Dollars starting bankroll: When the dice are passed to a new shooter, place a 10 dollar bet on the passline and 10 dollars on the Dont pass. You want the shooter to get through the comeout shoot and establish a point number. While this is happening, he might throw a 7, 3, 11, 2, etc which will result in the pass or dont pass winning and the other side having your bet taken. Thats fine, because it will be a wash, you have a bet up on the pass line and the dont pass line. This greatly reduces your edge against the casino down to a 1 in 36 when a 12 is rolled.

So here is the concept: You are going to be 5 counting shooters, qualifying them. While you are 5 counting them, you do not have money at risk as you have 10 bucks on the pass and dont pass. If during the time you are counting 5 rolls after they establish thier point number the shooter loses (7s out) or wins (makes thier point number) it will be a wash for you as you are betting do or dont.

The reason you are doing the 5 count is to eliminate shitty shooters that 7 out before they hold the dice for 5 rolls. And that tends to be a little over half the shooters at the table. The 5 count is kind of a guided missle for you to seek out all warm and hot shooters and skip cold shooters. This is how it works. When the shooter finally makes a point on the come out, thats 1. Now next any number the shooter throws (execpt for 7) is 2. Next any number (besides 7) they throw is 3. The next roll they do, again, any number they throw is 4 (besides 7).

For the 5th number, it has to be a point number and not 11,2,3,or 12. If the fifth roll they roll a 4,5,6,8,9, or 10, then thats "5". If you made it past 4, and then they roll a 2, That would be 4 and holding. Then if they rolled a 3, its still 4 and holding. Then they throw a 12? Still 4 and holding. The next number they throw is an 8. There you go. "5". Our five count is completed, and we

place odds backing up our Line bet.

Now, the concept here is we leave our odds up until we either win by the shooter making his point, or we lose, with the shooter 7 ening out.

If we lose, its the same thing again. 10 on the do, 10 on the dont pass, and do a 5 count. Each time a shooter 7s out before our five count, fine. You lost or made nothing, just avoided a bad shooter, and the dice slides over to the next guy and we start over again with our 5 count with our dice on the pass line and the dont pass line.

Our odds bet starts at 10 dollars. Every time we get past the 5 count and then put down odds and then lose, the next time we put odds down, its +1 on the odds. So, we lost our starting odds bet of 10 dollars, the next time we put down 11 dollars in odds and up it +1 every time we lose. We could eventually wander up into the 35, 30, or even 70 dollar territory.

Now, every time we win our odds bet, (that is, we made it past the 5 count and put odds down and left them out there until we won/ lost) and get paid, we will now be laying odds on the Dont Pass line.

Why is that?

Because if you look at statistics, winning two points in a row is not as common as just one point being made. Most of the time, a table will follow a win by a lose.

So, after you just won an odds bet on the pass line, we put up our 10 dollar bet on the pass line and our 10 dollar bet on the dont pass line and again, we wait for a point to be established. Once a point is established, we dont do any five count, statistics here say that it is unlikely for 2 points in a roll to be made and right away we lay odds on the dont pass at whatever point we were at in our progression (remember, every time we lost it was +1 dollar chip on our odds pile). Now remember, laying odds is different from puting odds down behind a pass bet. Lets say we were at 20 dollars in our progression. Seeing that 4 and 10 are double, we have to lay 40 dollars behind our dont pass bet if the point is 4 or 10. If the point is 5 or 9, we would have to lay 30 bucks behind our dont pass bet, and so on .

And we just leave the dont odds out there until there is a decision. If we lose, that means you have a hot shooter, and there was just 2 points in a row made. If we won the dont pass bet, we simply revert back to the do odds after doing a 5 count on the new shooter. So for example, we had a dont odds bet out there and the shooter 7ed out. That means we won our dont odds bet. We take the money, everything comes down or gets paid off, and its a new shooter. We place 10 bucks on the pass line and 10 bucks on the dont pass line and we once again 5 count our new shooter before we place odds on the pass line bet.

Now if the shooter beat your dont pass odds, that means he just made 2 points in a row. Which means you are at a hot table, or the shooter has some shooting skills and can influence the dice or maybe its just his lucky day. This means that you would then place 10 on the pass line and 10 on the dont pass and as soon as the point was established, you would immediately go up by placing pass line odds (at whatever point you were on the progression) behind your 10 dollar pass line bet.

If the shooter wins two more times (your pass line odds gets paid again 2 more times) place an additional place bet on any number of the same amount you are currently on for your odds bets. I myself put a place bet on its mirror number. For example, 4 and 10 are mirrors, 9 and 5 are mirrors, and 6 and 8 are also mirrors due to their same odds and payoffs. From that point if the shooter is hot, I will leave things out there, and let it ride and take the payoffs. If things keep hitting like 4 or 5 times, you might want to put a third place bet out there also the same amount as your currently bet odds bet.

You will find statistical deviation with this system, your chips on your rack will go up and down a bit and you could even be down 300-400 dollars. But you will see things correct and crawl back up for 2 reasons. 1) You are really cutting back the house edge by only playing odds bets, which the house has no edge on. The only thing that can hurt you on the pass line is a 12 being thrown on the come out. 2) Tables arent too often seen having 2 points in a row thrown. 3) You will be steering by not being at a table that is less than 1/2 full. No cold tables. Only be at a table that is half full or more. Shitty cold tables will have people cashing in thier chips and walking away.

4) $500 dollars starting bankroll: You will do the above system but with a twist. You will not take any action on anything until you see a shooter make two points in a row. This automatically puts you in a select group of shooters, with a good part of them being shooters that are hot, are precision shooters, or shooters that are just so happen to be having a good day. With this, you are really only going down the road of positive expectation.

You might say, well why would I then put odds on the dont after I win a bet on my pass line odds? Because if I won a bet on my passline odds, that would mean that the shooter just made 3 points in a row. True, but 4 points in a row are really rare, UNLESS YOU HAVE A TRUE PRECISION SHOOTER that can really roll long term to beat the house. Those guys/gals arent too commom. So after you win your first odds bet on the do, just like in #3 above, you bet on the dont. If you lose that as well, back to the do odds without a 5 count like above. Yes, you will 5 count a shooter after you see him win 2 points in a row when you are just starting out, as well. Ive been using this #4 system and have seen a lot of shooters who Ive seen just win 2 point in a row then bust out during the middle of my 5 count as I qualify them to jump in with an odds bet.

Well, thats it for now. Give it a try on the wizardofodds.com. Use the new craps version, V2.

Good luck,

Mark

(sequence

(sequence