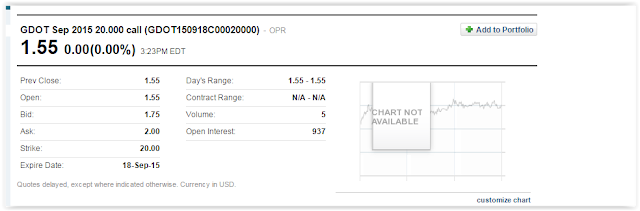

We are out of GDOT at 1.85.

This allows us to close out the GDOT spread with overall profit. Note the bid and the ask, we exit in the middle of the bid and the ask. The 1.55 just so happens to be the last previous trade, the MM now have this listed at 1.75 to 2.00 spread. I was looking for an out with the call, and I am unsure how the market will be next week because things look like they are topping out. Also, I did not want to be in GDOT throught its earnings annouucement date. Ah. Safety.

Well, I am on my way out the door here to go to Lollapolloza in chicago to see Paul McCartney in concert.

Everybody have a good weekend. I will update again on Sunday for the outllook next week and the Monday Forecast.

Tradinginsider

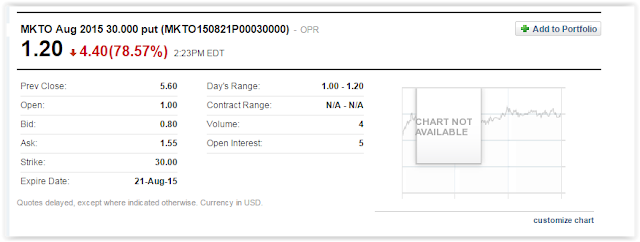

PS oh wait...theres the trade, just showed up

Have a good weekend!

This allows us to close out the GDOT spread with overall profit. Note the bid and the ask, we exit in the middle of the bid and the ask. The 1.55 just so happens to be the last previous trade, the MM now have this listed at 1.75 to 2.00 spread. I was looking for an out with the call, and I am unsure how the market will be next week because things look like they are topping out. Also, I did not want to be in GDOT throught its earnings annouucement date. Ah. Safety.

Well, I am on my way out the door here to go to Lollapolloza in chicago to see Paul McCartney in concert.

Everybody have a good weekend. I will update again on Sunday for the outllook next week and the Monday Forecast.

Tradinginsider

PS oh wait...theres the trade, just showed up

Have a good weekend!