Today MKTO announced earnings and it beat the street with good 3rd quarter guidance. Therefore everyone piled on this stock today huge.

Now, usually I stay away from stocks that just reported because the news overrides the technicals and if the stock had a really good earnings, people just keep buying it, driving the price yet higher.

However, I think this is a good opportunity for a straddle. A 1:2 straddle. One half the amount you would usually bet on a call, and a full amount you usually spend for the put side. Lets take a look at the chart:

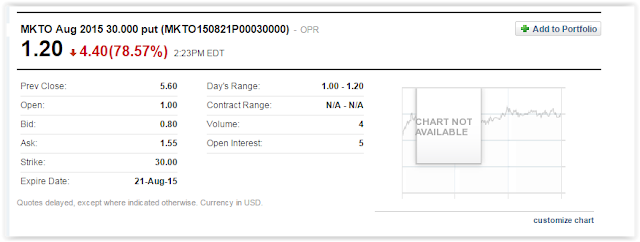

Looking at todays candle, you can see that it has a big upper tail, which signals that the stock hit its top and will come back down. However on the flip side of that coin, there was a big gap up from the previous days candle price and that is a big bullish signal. So now if I want to handicap this and decide the odds, I can then devise a strategy that I will use to pull some money. I am going to do a full priced (money I usually spend per pick) put on this:

And also at the same time, I am going to do that half priced call (spending half the money I usually spend on a put/call):

Now I have my 1:2 straddle.

You gotta risk it for the biscuit.

Tradinginsider.

Make 30% a month. Please excuse my dust-Under construction

Winning

Free "How to make 30% a Month" Ebook

Subscribe via Email

-

The charts are foretelling a very big problem, and in looking at it I can even gleam some timing from it by just following the indicators do...

-

I have always been a gambling enthusiast. What really sparked my interest in gambling was the new riverboat legislation in illinois/chicago ...

-

Today we short Lexicon Pharmaceuticals. They had a good phase 3 trial result. Lets look at the news: What : Shares of Lexicon Pharamceut...

-

Today we get in the cubes with a call: QQQ MayWk4 106 Call 1.30 1.31 1.33 131 Thats all for now....

-

Lets take a look at the QQQ (Nasdaq) upcoming for the day: As you can see the candlechart pattern is throwing a bullish signal. It is to...

-

We are in on the 20% call: FRO Dec 2014 1.000 call (FRO141220C00001000) - OPR 0.55 0.15 (37.50%) 3:08PM EST Add to P...

-

Right back into that option again as a daycall. QQQ Jan 2016 103.000 call (QQQ160129C00103000) - OPR 1.53 0.44 (40.37%) ...

-

Well, looks like cldx went the wrong way, but the day is still not over yet. It was at even money this morning, but we held looking for the ...

-

Good morning everybody. I exactly called it with the reverse double hammer near yesterday's close. If you had gotten in like I recommend...

-

In looking at all my charts, I believe at the beginning of next week we are going to have a bit of a surge, so I would like to ride that up....

Blog Archive

-

▼

2015

(691)

-

▼

July

(119)

- Late Day Trade GDOT

- GDOT beginning to move....

- Exit FLTX call for Profit

- IMMU set to blow to the upside

- Update in Progress

- Friday Forecast

- MKTO walking sideways...we have to sell

- Update in Progress

- Thurs Forecast

- We will be holding our positions

- SPY on the other hand made us 20% overnight!

- Exit yesterday QQQ calls

- Update in Progress

- Wed. Market Forecast

- New Pick: IMMU...Sell off too extreme

- Purchase QQQ and SPY calls

- Update in Progress

- Tuesday market Forecast

- Late Day Trade- FLTX

- MKTO: HOLD

- SPY and QQQ showing potential entry points

- Update in Progress

- NASDAQ forecast for Mon-Tues

- New Pick: MKTO

- Exit CARA put option 100% overnight profit??

- So what about Friday? Here's what will happen

- Late Day Pick....CARA

- We are going to hold on to that GDP call...

- Sell QQQ puts for profit

- QQQ Forecast for Thurs

- What if you had a Time Machine for the Stock Marke...

- GDP showing bottom

- exit DBVT short at 42.80

- Exit QQQ double down puts for Profit $$

- Exit our original SPY put for even money

- Exit SPY double down for Profit

- Update in progress

- The Apple Watch: Get that Kiddie Shit off your Arm

- One more exit...

- Exit SCMP double down put for profit....

- Double down on SPY puts

- Late Market Drop! Double down QQQ puts

- We are going to double down on SCMP

- Hold GDOT GDP

- I just got back from an all morning meeting. Asses...

- First G in the market? Heres how to play it safe a...

- QQQ puts issued

- NEW Pick SCMP

- Update on Current Positions

- QQQ Mania

- Hold SPY Puts

- Looks like the Market is going to keep going

- Purchase SPY puts

- DBVT short...hold

- Exit ZGNX Jan calls for profit

- Good Morning

- QQQ and Market Warning

- SHORT DBVT

- Got one for you...ZGNX

- Hold GDOT and GDP although....

- Update in Progress

- Market Outlook for Wed

- Market up, no bounce opportunities

- The early bird and the QQQ Forecast for Tuesday

- Exit Aug 107 QQQ calls for Profit

- EXIT GREK Aug 12 calls @ 1.30

- What's going to happen Monday

- Updated QQQ Technicals and Next week forecast

- Hold our QQQ August 107 calls

- Hold GDOT and GDP

- We hold our original GREK call, the August 21 twel...

- Sell GREK double down @ 1.50

- Friday Forecast 7/10/15

- Double Down on GREK

- Possible GREK calls to be purchased

- Watch RARE

- HOLD QQQ August 107 calls

- No additional plays on GREK or GDP

- We hold GDP and GREK

- Sell IART stock

- Sell SPY calls overnight gain of 14%

- Update in Progress

- Did 'Anonymous' Hacker Group Hack the NYSE?

- Skipped YANG purchase near close

- We may be making a trade in YANG today...check bac...

- So how did I do it today?

- Exit CNC Call for NICE Profit

- EXIT IART call for profit

- SELL QQQ Double down calls for slight profit

- Purchase SPY calls

- Update in Progress

- I called it...

- QQQ Bottom Signal-Purchase calls

- IART Hold

- GDP and GREK

- CNC Bottom signal confirmed

- Update in Progress...

- QQQ Forecast for Tues

- Last minute trade before close: CNC

- We shore up IART

-

▼

July

(119)

Recent Posts

Today

Coming Soon

Future area

daily Market

Report

Language

Copyright ©

The 1045 Report | Powered by Blogger

Design by NewWpThemes | Blogger Theme by Lasantha - PremiumBloggerTemplates.com | Valuable Stuff Online Distributed By Gooyaabi Templates

0 comments:

Post a Comment