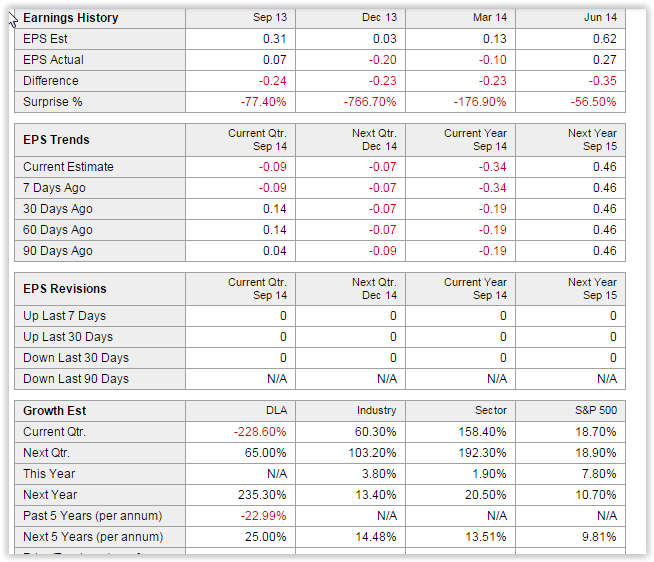

The pick for Tuesday is DLA. Lets get right to it. First of all lets look at its analysts estimates:

You can see that the stock has a way low Growth estimate in relation to its industry benchmark and the Sector. The more of a disparity between the two, the more rock and roll to the downside when the stock finally reports. Also look at the last 4 quarters of earnings surprises vs estimates. In the red all 4 quarters and there was even a HUGE miss of -700%. Add all this up, and there is a pretty good chance that things are going to drop when it reports later in the week. There has been a decent run up as well:

Look at the steady peak of the RSI. Same thing with the MACD and the MACD is even starting to show signs of a drop. While there are no options for this stock, we are going to short it providing that there is not a drop tomorrow morning: Here is the standing order. If in the first hour of trading there is no drop and perhaps a bit of a climb ( the main thing is no drop) go ahead and short it and we will hold it until Friday or the following Monday. If on the other hand tomorrow there is a big sudden climb, that will be an indicator of insider trading activity and we then dont want to touch it.

So the bottom line is if the stock is still holding or slightly up, go ahead and short it. I will be logging on tomorrow at about 12pm chicago time as I will be attending a seminar in the morning. I see no news in the pipeline, so everything seems set.

Good Luck,

Mark

Make 30% a month. Please excuse my dust-Under construction

Winning

Free "How to make 30% a Month" Ebook

Subscribe via Email

-

The charts are foretelling a very big problem, and in looking at it I can even gleam some timing from it by just following the indicators do...

-

I have always been a gambling enthusiast. What really sparked my interest in gambling was the new riverboat legislation in illinois/chicago ...

-

Today we short Lexicon Pharmaceuticals. They had a good phase 3 trial result. Lets look at the news: What : Shares of Lexicon Pharamceut...

-

Today we get in the cubes with a call: QQQ MayWk4 106 Call 1.30 1.31 1.33 131 Thats all for now....

-

Lets take a look at the QQQ (Nasdaq) upcoming for the day: As you can see the candlechart pattern is throwing a bullish signal. It is to...

-

We are in on the 20% call: FRO Dec 2014 1.000 call (FRO141220C00001000) - OPR 0.55 0.15 (37.50%) 3:08PM EST Add to P...

-

Right back into that option again as a daycall. QQQ Jan 2016 103.000 call (QQQ160129C00103000) - OPR 1.53 0.44 (40.37%) ...

-

Well, looks like cldx went the wrong way, but the day is still not over yet. It was at even money this morning, but we held looking for the ...

-

Good morning everybody. I exactly called it with the reverse double hammer near yesterday's close. If you had gotten in like I recommend...

-

In looking at all my charts, I believe at the beginning of next week we are going to have a bit of a surge, so I would like to ride that up....

Blog Archive

-

▼

2014

(153)

-

▼

December

(36)

- Nasdaq #qqq continues sideways in light trading week

- Light Trading Day for #stocks sell #QQQ calls

- Your Holiday QQQ Spread

- Outlook for the Week 12/22/14

- outlook for the week and site redesign coming late...

- The Rules for Success

- New midday Pick- PETX short

- QQQ point/counterpoint

- QQQ bounceback...where is it going

- A Break from Trading: How to Raise Your I.Q.

- What you have been doing wrong Trading Online

- IYE and XLE Energy Picks taking off

- Energy Just hit the bottom-buy!

- Sell yesterdays pick (ADXS) put for profit

- Daytrading: The Risks and Dangers Thereof

- How far will the Nasdaq (QQQ) drop? I got your answer

- New Pick

- Possible Big Drop Monday

- Update this evening on the week ahead in the market

- Todays Pick 12/12

- Sell FRO call- 100% gain Sell QQQ put hold GIS

- We are in on the 20% call: FRO Dec 2014 1.00...

- Sell Pran Option and FRO straddle 12/11

- Outlook for Thurs Dec 11th

- PRAN...annouced Stage 2 purchase puts

- Purchase GIS Put

- We are watching GIS tommorrow and QQQ update!

- Dump DLA

- General Foods (GIS)

- DLA, CCL, QQQ and other pics...

- Watch list for this week 12/8 in the market

- QQQ In depth Forecast for 12/6

- QQQ Advisory Service begins....

- GCO update

- Pick for 12/4-GCO

- DLA new pick for Tuesday 12/2

-

▼

December

(36)

Recent Posts

Today

Coming Soon

Future area

daily Market

Report

Language

Copyright ©

The 1045 Report | Powered by Blogger

Design by NewWpThemes | Blogger Theme by Lasantha - PremiumBloggerTemplates.com | Valuable Stuff Online Distributed By Gooyaabi Templates

0 comments:

Post a Comment