DayTrading: The Risks and Dangers Thereof

A Brief History

In the 1950's and 1960's any day trading was done by professionals, and even then with the analogue systems of the day with their order placement it was far from today's daytrading system placing that can be done in one second. Some wealthy individuals went to off room trading centers that were connected to brokers and their boys on the floor from large company trading rooms.

So when somebody was looking to purchase a stock that they've been following they would contact their broker and buy shares in a company. Your average man would typically stay with his buy for a minimum of several months, and a lot of people would invest the old fashioned way: they would just park their money in a stock and forget about it.

My friends grandfather bought several thousand shares of GM in the late 1920's and just sat on it for 50 years. I remember in the 80's he was worth quite a bit of money through his grandparents inheritance. (I hope that he sold it before the GM collapse.). My uncle bought Walgreen stock in the early 70's and he rode out Walgreens' expansion for the next 4 decades and now he has a bit of coin himself.

The Market Makers, or the individual or company the provides liquidity for the trading of a particular stock, sets the buy and sell point of the stock they are working, and they take the difference between the spread of the bid and ask in order to make money for themselves, much like a bookie. In the 1950's and 1960's since people weren't coming in and out of stocks that often, spreads were wide, and market makers were enjoying little competition while working, making a decent living. People would purchase stock and hold it for a year or longer. Funds would purchase stock and hold. And everything was good for the investor and the Marketmakers.

The Internet and the late 1990's-The New Frontier of Daytrading

After a few years of the emergence of the Internet, online trading showed up with companies like E trade, Webstreet and WeathWeb, which allowed traders to maintain their own accounts without brokers, buying and selling themselves. This was the emergence of daytrading. Commissions dropped drastically because there was no full service brokers with having your own online trading account.

People then got the idea that they could trade in and out several times a week, monitoring the internet full time for market activity instead of watching it at the end of the day on the news.

And then people started trading every hour, then every five minutes, then every minute, trying to scalp an eighth of a point or even a sixteenth.

That unfortunately for everyone, was taking the money right out of the market makers pockets.

The Market Makers Go To War

Suddenly the market makers money machine was being stolen by the thousands of day traders that were sitting around in their basements on their computer trading in and out every few minutes. This is exactly what the market makers were doing for the last 50 years but now due to the change in technology, everyone was doing it. So the market makers decided to do something about it.

You see, the market makers have a secret weapon. They can control the price of the stock. They decide which orders they want to fill by looking at the sitting buy orders and the sitting sell orders. Imagine playing tennis against an opponent that is not only good, but can control the ball midair. You take a swing at the ball with your racket, and the ball controlled by your opponent stops dead, does a figure eight around your racket, and suddenly flies the other way. You can never win against such an opponent. (For the rest of this series, go to www.the1045report.com)

This caused people in the late 90's and early 2000's to lose their nest eggs and they ended up day trading it away. The Market Makers would look down at their order boards and identify traders that they felt were sitting at home trying to scalp fractions of a point by swinging a decent chunk of money in and out several times an hour or even minute by minute. They would fill the traders order and then promptly cause the market to go the wrong way by filling orders contrary to the need of the daytrader via his or her position. This would shake the day trader out of their position and force them to sell and take a loss rather than stay in and take a bigger loss.

This didn't go unnoticed by the media. In the early 2000's many newspapers ran stories of people that cashed in their IRA's, sold their businesses, or borrowed money in order to be a full time daytrader.

And then they promptly over the course of the next several months, lost their money. They lost their money in a rigged game: the market makers were controlling the ball. It was an expensive lesson.

The Flip Side of the Coin

Some people might say, I'm staying out of the Market

Maker's way, Im just going to buy and hold. Well that is almost taking a pair of dice and rolling them at a dice table: the more time that goes by from the time you make your purchase, the more of a chance chaos will fractal things into several of many possible directions.

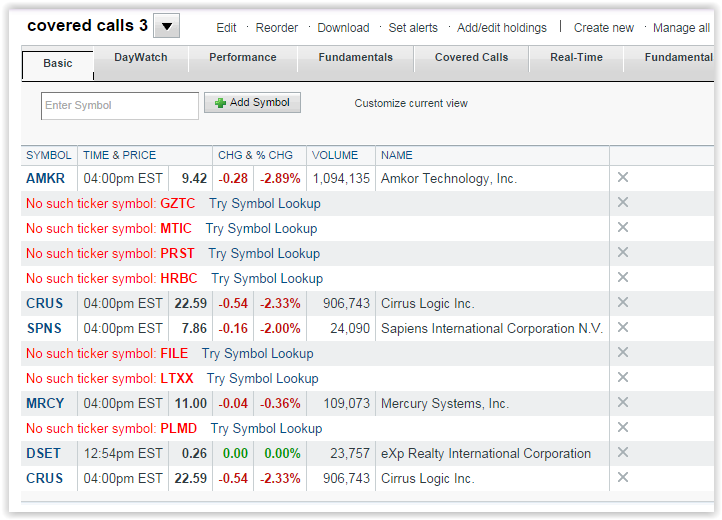

Let me give you an example. In the late 1990's, I was watching and playing with some stocks so I decided to go on yahoo and create three active watch lists. I probably had 10-15 stocks per watch list. They were priced on average from 1 dollar to about 23 dollars for the priciest one. I played with it for about a year, checking them every day, and then when I moved in 2000, I forgot about them. 14 years went by. Then just earlier this year, I was moving around on Yahoo using my handle Tradinginsider that Ive had since 1994 when I first signed up for Yahoo mail, and I stumbled upon these 4 old watch lists that I was using for Covered Call writing in the late 90's when the market kept on climbing and climbing. I found that even after 14 years, they were still active and Yahoo had been updating them daily. I looked at them fascinated. I marked the lists Covered Calls, Covered Calls 2, Covered Calls 3, and the Dump list. So now its 14 years later, and lets take a look at them and what happened:

As you can see, several things are apparent. First and foremost, there is only one home run that occurred out of the 41 stocks that I had listed. In addition, notice that the one home run, the pharmaceutical company ALXN, was the one I had placed on the above dump list because I didn't think based on its price action that it was going anywhere. Also notice how many of the stocks were no longer in business or had been bought out by other companies: you can see those are now in red where it says "No suck ticker symbol: (XYZ)" all over all 4 of the above watch lists. I mean, without a crystal ball, who knew how this was going to shake out 14 years later? In order to invest or make any money to find that one home run I would have had to place 1 or 2 grand on each one of the 41 stocks back in the late 1990's and spend $41,000 to $82,000 and then forget about the money and leave it parked for 14 years. It was a turkey shoot.

When you are investing long term, a lot of things can go wrong. First, lets look at the Nasdaq from the late 1990's until now.

If you had gotten in at the late 90's you would have about come out even 14 years later. There were two crashes in the interim and if you had the steel balls not to sell and get your money out during the crash of 2000-2002, you probably would have thrown the hat in and given up during the crash of 2008. Lets say for example that you did leave your money in the market. Could you have stood to come out almost even over the course of 14 years, with inflation eating up your dollars at the rate of 4% a year? This is why 401Ks take a beating in the long term. No one knows where the corrections are going to be and for how long.

Lots of other things can go wrong when you invest long term. The companies officers could be stealing from the company and keeping two sets of books. This happened with Mercury Finance, and some other big energy companies such as Worldcom and Enron. As a matter of fact, a few of thier officers were taking money and building homes in Florida because the law says in Florida you can't seize a home built there because of a financial or custody court case. Companies can be chugging along and suddenly the market forces can change making their product obsolete, or the officers vision for emerging markets is faulty and the stock drops in price, goes out of business or gets bought out by another company.

You just don't know without a time machine. Investing in the long term is tough. Warren Buffet can do it. It takes a lot of talent, and a lot of vision. And a time machine. If I had a time machine, I would go back to the early 80's, mow a lot of lawns as a 13 year old, and caddy a lot for a couple of summers. I would then put a few grand in Microsoft in 1986 and sell it in 1999. So, anyone know of a good time machine?

The Big Secret

The best trading window to get around both problems that I covered above is a trading window of 2-3 days to 2 and a half weeks. First of all, you want to avoid the Market Makers territory by trading in and out in the same day. Especially trying to scalp tick by tick. You do that, and the MM will take all of your money. I knew a guy who sold his Pizza shop and scraped together 75 grand and daytraded it away.

With a 2-3 day to 2 and a half week window, you can stack the deck in your favor by going against the crowd. While I will cover about going against the crowd in a later post, I will cover how to trade using the big secret below using these two time frames:

A) 2-3 days: Go to the Yahoo finance page and look up the Earnings calendar, and look for stocks that report quarterly earnings that day 2-3 days in the future. Now look at their analysts expectations. If they are all low, and in the red, then go to stockcharts.com and check to see if the stock has been steadily climbing in price for the last week and a half leading up to earnings. If it has, and the analysts expectation is crap, and 3 out of the last 4 quarters there has been negative earnings surprises, this means that the crowd is wrong, the stock is going to report bad earnings, and the stock is going to drop. To go against the crowd, I would purchase a stock put on this stock (providing it is optionable) 2 days before it reports, and then the day of its earnings announcement, the stock will most likely drop and the put will jump in price. You then sell the put on the earnings date for a profit. The crowd is almost always wrong, you are profiting by going the opposite way of the crowd.

B) 2-2 and a half weeks: Go to the Yahoo finance and look up the Earnings calendar and go out 2-2 and a half weeks. Go on down the list and look for stocks that have great analysts expectations with numbers that are in the black, and high. Look at their last 4 quarters. If 3 out of the last 4 quarters there has been earning surprises to the upside, then there is a good chance that this stock is going to do the 2 week climb leading up to earnings. Purchase call options at the money either for the current month if at the beginning of the month or the next month out. 2 days before the stock announces, sell your options for a profit after the stock climbed up. You want to sell two days early because trading insiders on the stock room floor start to leak the news out ahead of time and this can manipulate the price of the stock and cause it to start dropping early if the news is bad thus eroding our option price.

In doing the above you will have to analysis the market first by looking at the QQQ charts first to determine which way you think the market is going to be going. If you have analysed that the market is going to be dropping over the next several days, you want to go with option A above. The market will aid your put drop, its like a beach ball (your stock) being carried on the wave of the ocean (the stock market). If you think that the market is going to be going up for the next 2-3 weeks from your analyzation of both the daily and the weekly charts for the QQQ (weekly is more for long term forecasting) then use option B above. The market will go up and drag your stock up with it, helping your call option to rise with it.

Now there are several particulars that you want to observe and pay attention to: How to forecast the market using candlesticks on stockcharts.com, things about the analysis's expectations and how to interpret the data ratio comparison to the industry, sector and s+p benchmarks, and other things such as how to maximize profit with the option chain and if to use the same month options or go one month out. All of this will be covered in this Stock Trading Primer 10 part series.

Mark

.jpg)

.jpg)

0 comments:

Post a Comment