I am going to come in with a QQQ call that expires in two weeks.

Why am I doing this? I am hedging my bet that this comes back, but not dangerously as I am not playing with call that expire today anymore. I used them for a quick recovery, and now they are too dangerous as they are going to expire today.

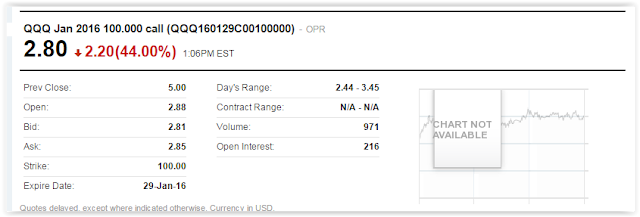

With a call that expires in two weeks, this will give me some padded time in case the market continues to crash on Monday. And if the market bounces, I exit this. Here is my in:

Now I would like to talk about how I take advantage of strike prices as they can be a very potent weapon in a traders arsenal. For example, on one of yesterdays posts I said that during normal days (unlike today) I like to purchase an end of day order about a week or two out and hold overnight. This allows me some time in case if fresh adversive news comes out pre market about the Asian markets or a bad market report preopen. Then during the day after the gap at about 1030 two hours after market open (central time here in chicago) I then like to go with the momentum of the market and go with a daycall or a dayput that expires as soon as possible. With a strike that is about to expire ( that day or the next day if possible) I get maximum movement in price. Seeing that during the day there is no huge announcements that can derail the daily momentum like there is before market open this tends to be a safer bet so I take on more risk with a very soon to expire option to get bigger moves to offset the end of day option that expires in a week or two from the day before if need be.

See what I am getting at here? There is another way besides doubling down to hedge your bets, there is the increased volatility in closer option expiration dates that can also allow you to hedge.

So I am going to hang back here at this point and come back about 15 min before close to measure the markets and give my reconn.

Tradinginsider

Make 30% a month. Please excuse my dust-Under construction

Winning

Free "How to make 30% a Month" Ebook

Subscribe via Email

-

The charts are foretelling a very big problem, and in looking at it I can even gleam some timing from it by just following the indicators do...

-

I have always been a gambling enthusiast. What really sparked my interest in gambling was the new riverboat legislation in illinois/chicago ...

-

Today we short Lexicon Pharmaceuticals. They had a good phase 3 trial result. Lets look at the news: What : Shares of Lexicon Pharamceut...

-

I live for events that rock the market because its a great time to buy in on the cheap. Anyone here think that the QQQ, Nasdaq or the Mark...

-

Right back into that option again as a daycall. QQQ Jan 2016 103.000 call (QQQ160129C00103000) - OPR 1.53 0.44 (40.37%) ...

-

Well, looks like cldx went the wrong way, but the day is still not over yet. It was at even money this morning, but we held looking for the ...

-

QQ JunWk4 107.5 Call 1.48 1.54 1.55 773

-

Just wanted to let you guys know that I am backing off this site a little bit because I have a lot going on. However, I will still be in and...

-

Ok, I almost made 100% on the dayput to make up for the daycall loss We exit: QQQ Jan 2016 101.000 put (QQQ160115P00101000) - OP...

-

Good afternoon. Today the QQQ did something interesting...it threw a bullish signal. Look at the chart below: What does this mean? When ...

Blog Archive

-

▼

2016

(374)

-

▼

January

(107)

- I was watching that all the way to close.....

- Ok, now we are going to add on

- Purchase dayput

- ok, here is what the map says

- outlook for today

- Lets talk today...

- No orders

- exit that last 45min dayput with 7% profit

- Lets try this last hour drop....

- Exit dayput

- Dayput issued

- exit first daycall for profit

- purchase QQQ calls

- I was staring at the data and then I was thunderst...

- No end of day orders

- So how did I do today?

- Exit second dayput for even money

- Exit first 9:15 daycall option

- I am going to hold these two puts

- ok, lets shore this up

- Purchase QQQ puts

- papa's got a brand new bag

- exit daycall

- daycall reversal

- daycall issued

- I am closing out the spread from last week with an...

- So how did I do today?

- End of day order

- Exit Dayput

- Not enough volitility

- dayput issued

- dump QQQ DD puteven money

- Monday

- Saturdays Post

- 2 down one up

- exit daycall

- daycall issued

- exit dayput with slight profit

- Day put issued QQQ

- Good Morning Exit calls half of spread

- Asian Markets way up

- and now for something very dangerous

- Here is what we are going to do with the daycall

- Ok, on that dayput...

- Daycall order issued

- We exit the overnight DD calls at even money

- We hold the overnight DD calls

- Good Morning

- Asian stocks take another beating

- So, how did we do today, Wed Jan 20th 2016

- QQQ and Nasdaq at cycle bottom

- Exit daycall (the reversal from an hr ago)

- reverse dayput into daycall

- Today we purchase a dayput

- Exit the puts part of last nights spread for profi...

- Uh oh, Asia overnight....

- Partial Spread for Tomorrow..here it is.

- So to recap

- Exit dayput for profit

- purchase QQQ dayput

- Exit calls part of the spread for profit: QQQ Jan...

- Bad earnings and Asia having a bad night

- No action today...MLK Jr. Day

- What is going to happen Monday/Tuesday

- End of Day Decision

- Just made some more money...exit QQQ jan 29 call

- New action

- Wow. CRAZY DAY

- EXIT DAYPUT

- Big BIG drop today

- You guys are wondering what Im gonna do now, right?

- Asian Markets overnight

- End of Day Order

- Hmmm. I think I have a system going here...

- and the fun pays off

- Lets have some fun

- ok, Here it is for today..

- Sell yesterdays end of day

- Well, you didn't win Powerball...

- ENd of Day Orders

- We are gonna throw a longer term one out there....

- Exit Walmart Put option for 34% overnight gain

- sell QQQ end of day calls for even money

- Good Morning

- End of Day QQQ call

- Walmart: Looking oversold and crap techs

- This is what we are watching for today near close

- exit yesterdays end of day order

- I will be on at approx 1030 chicago time on Tues

- End of day order

- We are going to hold for later today

- exit DD calls

- Here is the overall situation

- Purchase QQQ DD calls at the money

- Good Morning

- Purchase SPY call hold overnight

- EXIT QQQ DAYPUT DD 100% GAIN

- Good Morning

- Good Morning

- New End of Day orders

-

▼

January

(107)

Recent Posts

Today

Coming Soon

Future area

daily Market

Report

Language

Copyright ©

The 1045 Report | Powered by Blogger

Design by NewWpThemes | Blogger Theme by Lasantha - PremiumBloggerTemplates.com | Valuable Stuff Online Distributed By Gooyaabi Templates

0 comments:

Post a Comment